Best Recession Indicator Eurodollar Index Flashed Red

What next for S&P 500 & Gold?

The most important index, the Eurodollar Index, is one index that no one is paying attention to, and it just turned RED. The last time it turned red was one month before the US Federal Reserve (Fed) started cutting interest rates in 2007, and one month before the fed started cutting in 2001. In both cases, the US entered a recession within six months. How do we know no one is paying attention to the Eurodollar Index?

Google Says No One Is Paying Attention

You probably have never seen the coming chart before. When you do a Google search on Eurodollar Index…What happens? You only get 2,410 search results on Google. Think about that for a second. There are tens of thousands of investment professionals around the world, maybe even hundreds of thousands, there hundreds of millions of retail investors, and yet when you do a very specific search on the Eurodollar Index, less than 3,000 searches show up.

Then when you look at news articles, the media isn’t paying attention to the Eurodollar Index either. Only 2 news articles have been written on it.

Yet, “The volume in Eurodollars (traded at the CME) is beyond anything you gold and crude oil can comprehend. Consider the following volume figures for 2012: Gold – 43.8 million contracts, Crude Oil – 134.2 million contracts. Eurodollars – 425.1 million contracts”

Something Broke in the Markets

When you read about the markets you hear about: Valuation metrics, like P/E or P/S.

But this doesn’t help you, the investor, because things can get much more expensive than investors think or they can get go much lower than they expected, which many commodity investors from 2012 to 2016 were caught up in value traps.

This is why we look for the sweet spot to avoid the value strap by not being too early. In order to get the capital flow coming in, we are looking for momentum to come back into the sector and/or stock.

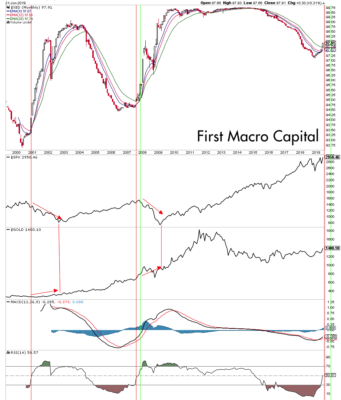

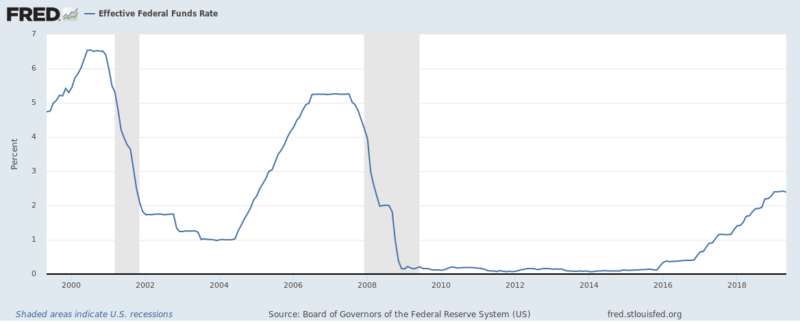

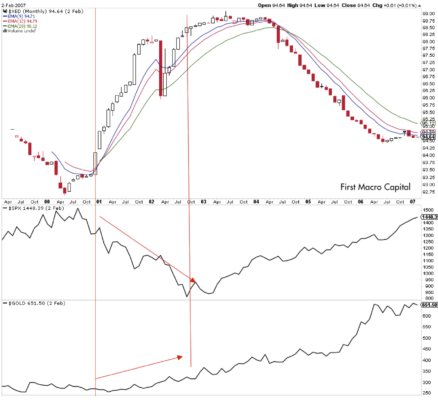

Let’s have a look here. This is the Eurodollar Dollar Index going back to 1999. It really helps give us the temperature of the banking system.

“Somewhere out there in the banking system – There is some bank or multiple banks that cannot get funding.”

Going back to 1999, every time, AFTER the index went from a trend of falling for a number of years, bottomed, and flipped to start accelerating again ABOVE the moving average this was a clear warning SIGN that something is not good in the bank deposit markets.

Pay attention here. In December 2000, when the Eurodollar Index broke above the long-term averages, its momentum only further accelerated from there before the crashed the ensued from there. In August 2007, when the Index broke above the long-term averages, and this was the point the acceleration took resulting in the next recession which brings us to today.

So where are we today? We are back to where we were in 2001 and 2007. The Index has broken above the long-term averages.

Why is this important?

Music Has Stopped

It all comes down to liquidity. Back in July 2007, the CEO at the time of Citigroup, Chuck Prince made this now infamous quote. “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get and dance. We’re still dancing” (Ft.com)

Just one month later, as we mentioned previously, in August 2007, momentum for the Eurodollar Index accelerated back above the long-term averages, which highlights the music has stopped.

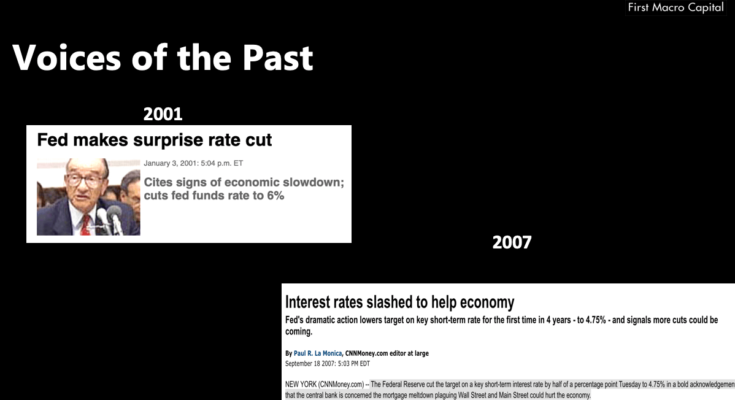

Voices of the Past

In every instance that the Eurodollar Index accelerated, the US Federal Reserve cut interest rates. In January 2001, the US Federal Reserve made a “surprise” rate cut before the recession started. Looking forward to September 2007, one month after the Eurodollar Index Accelerated higher, the US Federal Reserve cut rates for the first time in 4 four years. Now that the momentum accelerated higher, we shouldn’t be surprised that the Federal Reserve will cut interest rates, and it’s not because it’s a good sign.

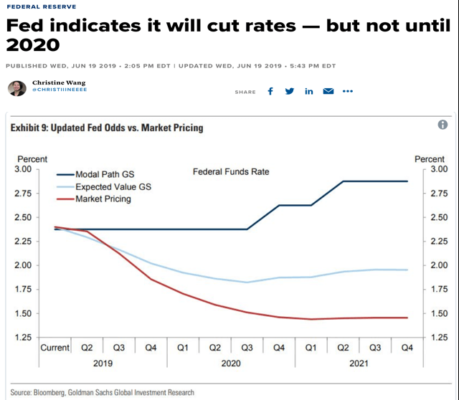

Today: Fed vs Everyone Else

And yet today, the Fed says it won’t cut, until 2020. Yet we know from history that when Eurodollar Index accelerates above its long-term momentum, the Fed Funds rate falls, which it is doing today, and within a month the Federal Reserve cuts interest rates. Why? Because something bad happened. Will it be tariffs? Who knows? But something has broken and the US Federal Reserve will need to act.

Recession Within 6 Months

In November 2000, the Fed Funds rate was 6.51%, a month later in December 2000, the Eurodollar Index accelerated above the long-term averages and by May 2001 the US was in a recession. Then in July 2007, the Fed Funds rate was 5.26%, a month later in August 2007, the Eurodollar Index accelerated above the long-term averages, and by December 2007 it was the start of the US recession. Fast forward to today and the Fed Funds started falling in May after peaking, then in June, the Eurodollar Index accelerated higher breaking above the long-term moving averages. That puts a recession starting in the range of October to November of this year.

S&P 500 & Gold in 2000

As the Eurodollar Index accelerated at the end of 2000, the S&P 500 peaked higher initially before stumbling into a 2-year bear market. Gold blasted higher initially, then stumbled lower for the first half of 2000, before more than doubling from the inflection point.

S&P 500 & Gold in 2008

As the Eurodollar Index accelerated in 2008, the S&P 500 peaked higher initially before stumbling into the 2008 bear market. Gold, on the other hand, blasted higher for a number of months just like silver. Both gold and silver fell late 2008, but gold remained above the August 2007 inflection point.

Now You Know

- Momentum has now accelerated confirming the value trap is now over for the Eurodollar Index. It is now in motion, and if history repeats, the S&P 500 wins briefly before losing over the next six to twelve months.

- Gold won in both 2001 and 2008.

- Silver is a mixed bag of beans. Interest rates have a high probability of being cut next month, the music will stop, and the excitement is only getting started. Now you know.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!