Q: Is the 2010’s ICO bubble similr to the 1990’s US tech bubble?

Did retail investors beat the “smart” money to the party?

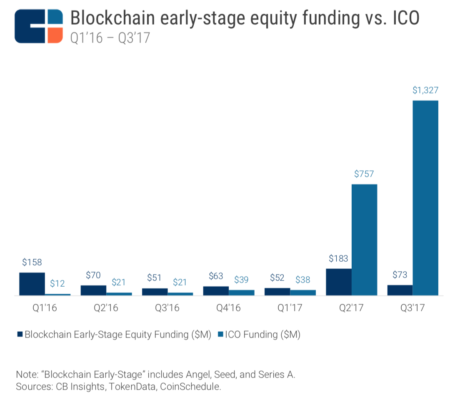

A: The retail investor is investing like it is the 1990’s but because of the lack of IPO’s since many technology companies are staying private longer (AirBnb, Planatir, Uber, Pinterest), initial-coin-offerings (ICO’s) are gaining a lot interest of the retail investor interest since they have become more accustomed to investing in more speculative venture because of the launch of crowd funding, and peer-to-peer lending.

While all the attention is given to Bitcoin, and ethereum, Blockchain, is the internet of the 1990’s. Bitcoin and Ethereum are the “website” that sits on top of the blockchain, “internet”. The real jewel in this crypto craze is the blockchain. This is what smart investors and entrepreneurs are thinking about in building something over the long-term.

The next Jeff Bezos, Bill Gates will come from someone that has developed a business for consumers that sits top of the blockchain.

Similarities of the 1990’s to 2010’s

- The retail investor was very involved in the the crypto craze and are becoming millioniare overnight

- Retail investors were becoming overnight millionaires on IPO’s that would increase in value by 100%

- Rap

- The ICO (initial coin offering) is the the 1990’s version of the IPO

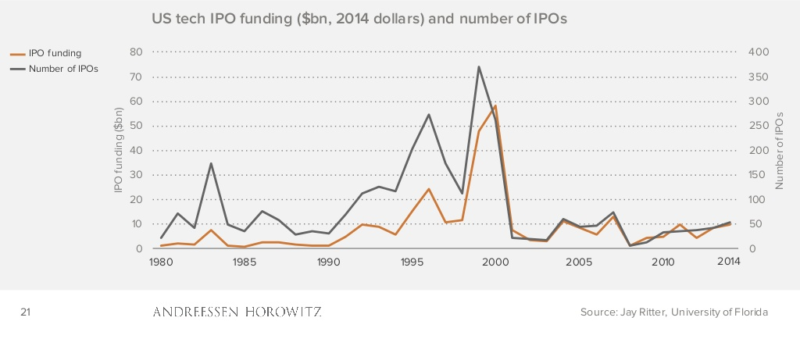

- During the US tech boom, the number of IPO’s peaked at 350, and raised over $60 billion.

Smart-Money Warnings on Valuations

Companies were being valued on hope of a new paradigm shift with the internet. No you are seeing initial coin offerings, and blockchain companies, crypto currencies and other technology companies being valued on a new paradigm shift in how consumers, businesses, and governments buy and sell goods and services.

Just like in 1999, you are seeing value investors start to speak up a bit more about how investors are valuing businesses.

- Warren Buffet in 1999

- “Investors in stocks these days are expecting far too much, and I’m going to explain why. That will inevitably set me to talking about the general stock market, a subject I’m usually unwilling to discuss. But I want to make one thing clear going in: Though I will be talking about the level of the market, I will not be predicting its next moves. At Berkshire we focus almost exclusively on the valuations of individual companies, looking only to a very limited extent at the valuation of the overall market. Even then, valuing the market has nothing to do with where it’s going to go next week or next month or next year, a line of thought we never get into. The fact is that markets behave in ways, sometimes for a very long stretch, that are not linked to value. Sooner or later, though, value counts. So what I am going to be saying–assuming it’s correct–will have implications for the long-term results to be realized by American stockholders“

- David Einhorn 2017 – Is there a ‘new paradigm for valuing equities?’ he asks

New Industry Opens Up to the Masses

Entrepreneurs are learning the benefits of implementing the blockchain across different industries. The crypto currencies are the first phase of the cycle. Just as website launches were the first phase before apps on phones became more useful

Business Models with new buzzwords

When we look at what Business models in the 1990’s were based on building a website and primarily the desktop and software for the desktop.

- Website

- Worldwideweb

- Bandwidth

- Internet Shopping

- Software

The business models on the blockchain with cryptos are still being developed and new terms are being used that investors, entrepreneurs, consumers are having to learn.

- Initial Coin Offering

- Blockchain

- Digital Ledger

- Triple Entry Accounting

- Token

Consumer adoption of buy & selling goods

The adopters of those buying and selling goods on the internet in the 1990’s was still low because of slower internet bandwidth. The buying and selling of goods with cryptos, is still low because the average consumer isnt really sure what is it, and the number of businesses accepting it is low.

What is missing from the 1990’s/2000’s boom?

- The mega-mergers from 1999/2000:

- Merger’s post tech boom, pre-financial crisis:

- The mega-mergers thus far since 2008:

The Vodafone transaction in 1999 would be priced at $290 billion in 2016. We have not yet seen the end of the cycle until some of these big M&A transactions.

How will Blockchain impact the mining industry?

- It will improve trust because buyers and sellers will be able to verify the gold from the specific source the gold was refined from. At the moment it is manufactured from and entered into the gold blockchain it will be completely traceable for as long as the ledge exists. This should reduce transaction costs between buyers/sellers and dealers, because dealers will have increased competition, since the gold will be trusted due to its verification ability.

- The end consumer will be able to sell their bullion to more trader’s, because there is more trust in the system reducing fraud premium, when dealers buy back the bullion.

- It will eliminate fraud sold to consumers, which tends to happen on a weekly basis when you do Google searches and happened recently in Canada when a 1 ounce Canadian Maple was sold by a major bank. With a unique code, it will be entirely traceable each time a transaction occurs for complete verification.

- Supply chain improvements within individual miners, as they use internal blockchain ledgers to better manage their production, by increasing automation and record keeping within their operations, resulting in a reduction of overall costs.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!