Netflix, a member of the FANG group and a poster-leader of the streaming boom. Netflix was able to get a first mover advantage over Amazon, Apple, Google. The streaming boom that took the world over since 2008 and the US economy emerged from the 2008 recession. In every cycle there are winners, and it is very difficult to dominate a sector one business cycle after another, particularly when the product requires constant innovation.

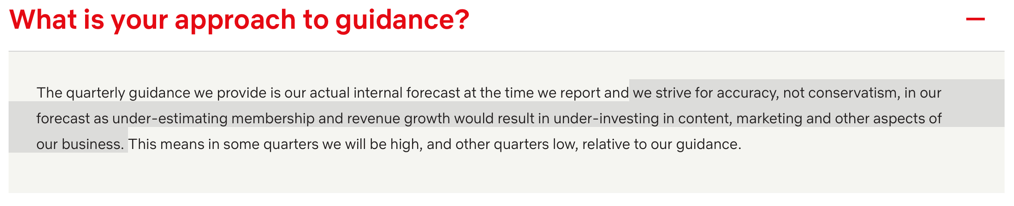

It is very difficult for a company to turn a successful trick into a second trick. “In a lot of businesses, you are forced to do a second trick, or you die,” said Steve Ballmer (Former CEO of Microsoft). Very few companies are able to make it to the third trick. Netflix has made the trick from DVD’s to online streaming and then delivering its own content. But what happens when major players start removing content from Netflix as we will see accelerate in 2019 and 2020? What happens when debt markets seize up, as they always do during recessions, which Netflix has stated it plans to use for capital expenditures? What happens when 5G accelerates internet speeds by more than 10X? Video watching could be totally different with 5G in how consumers watch media. Add in lower cost options potential coming from Costco.

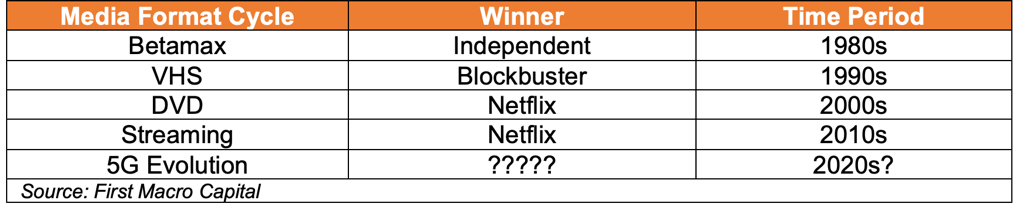

The Media Watching Cycle

While many are focused on the streaming in the current cycle, we place it in the bigger cycle, which we call the “media watching cycle”. The Media Watching Cycle is the different forms of media that consumers have used to watch movies. During the 1970s Betamax dominated the markets, this than transitioned to VHS in the 1980s, followed by DVDs in the 2000s. With high-speed internet rollouts, we had consumers ditch the DVD for streaming. But what happens to media watching with 5G speeds?

Sources: Business History Review, Nexus Research.

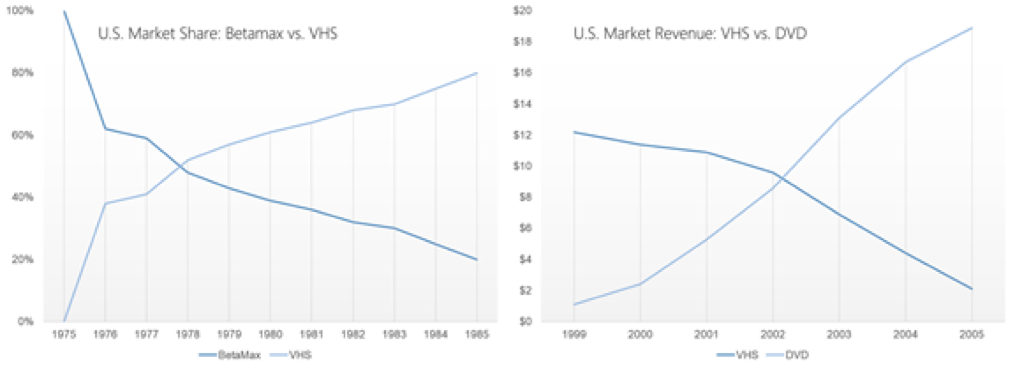

At the end of 2018, Netflix had 58.486 million subscribers in the US market, but they believe their reach is “60-90 million homes” in the US market. Netflix is less than 3% away from hitting the low end of its target or potentially 1 quarter away. Is Netflix’s next quarter the US subscriber peak? Is this a conservative or accurate estimate on the low end? Netflix has stated its approach to guidance, “we strive for accuracy, no conservatism, in our forecast, as under-estimating membership and revenue growth would result in under-investment in content, marketing, and other aspect of our business.”- Netflix

Source: Netflix

Source: Netflix

The Chart Says The Peak Is In

On a technical perspective, the stock exploded higher since December 2018 but is hitting a resistance level. In our view, this recent rally is only a dead cat bounce as the business cycle finishes. Investors appear to be wondering, as competition has only accelerated, capital expenditures continue to remain elevated, content is pulled from content providers, and lower price options enter the market.

Netflix Is In Phase 3 of the Current Media Watching – Commodity Hype Cycle

Common Peak Examples at top of Cycle in Phase 3:

- Price: Large Price Increase. Potential peak in prices – Check

- Demand: Demand growth rates begin to slow from high prices – 2019 in the US Market?

- Supply: New supply comes online. Aggressive M&A. Alternative supply becomes economically viable. Supply online, consolidation in the waiting?

- Investor Psychology – Everyone wants in: Buy, Buy!! – 2018- Check

HERE COMES THE COMPETITION

There are now more than 13 major streaming companies in the US, and this is a common trend at the top of the cycle. An oversupply of options becomes available to customers, just when the cycle is peaking. Maybe Netflix gets purchased by a larger player company because they have a huge pile of subscribers? Maybe Netflix buys a smaller company?

Source: CNBC

But then there are the companies that are removing their content from Netflix in 2019 & 2020:

WHAT HAPPEN’S NEXT?

Phase 4: After the Peak

- Price Drops

- A major player goes into financial stress

- Demand goes negative

- Oversupply of options for consumers, with limited differentiation

- Investor Psychology: Still hope it will go back up

WHERE IS THE CASH?

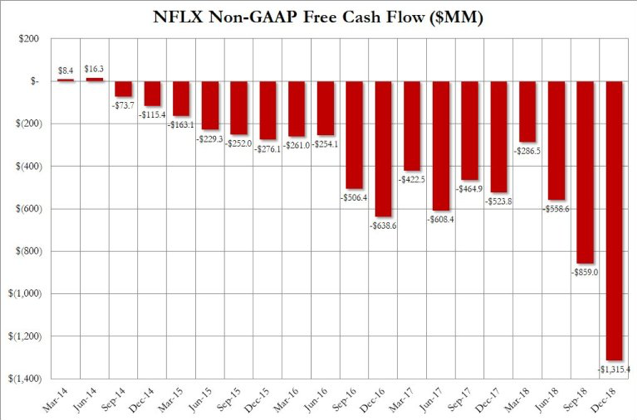

Management stated that the company expected to generate negative free cash flow in 2018 of -$3 to -$ 4 billion, and finished 2018 with -$3.02 billion in free cash flow. Management anticipates to “being free cash flow negative for many years”. Eventually, the debt clock runs out as the business cycle checks in with reality for those relying on the debt markets to fund their costs. This outside reliance could put Netflix in a precarious position that will come to light as the US economy falls into a recession, in our view 2019? What happens if debt markets close up like that have in past cycles?

In 2019, management expects free cash flow to be similar to 2018, which is another -$3 billion free cash flow. If the current cash is $3.8 billion up from $2.8 billion, then we would expect Netflix to raise another $2 billion. Let’s keep something in mind for a second, the company is raising prices this year and still expects the company to be generating the same negative free cash flow amount, not including doing any material transactions. “We expect 2019 FCF will be similar to 2018 and then will improve each year thereafter (assuming, as we do, no material transactions)”– Source: Netflix

Notes from Netflix 2017 letter: “High yield has rarely seen an equity cushion so thick.”

Source: Netflix

Source: Netflix

Source: Netflix

IS NETFLIX RECESSION PROOF?

comes to an end, the biggest tests for Netflix, how will pricing evolve as competition heats up? What happens when’s credit market seize up, and Netflix needs to raise debt to fund its capital expenditures, which it relies on raising debt to pay for its content development?

Netflix won the first cycle of streaming in the 2010s, but who comes out the winner on the other side of this business cycle to dominate after 2019/2020? What will 5G do to video watching, if 5G internet speeds are 20X faster than 4G? Will a small player or another competitor be quicker to adapt to it? What happens when credit markets seize for a long period of time and it becomes more difficult to raise capital to fund the development? The current cycle for streaming video, we will see increase pricing competition as competitors try to cannibalize one another’s customers. Yes, consumers may have a couple of options, but not all of them. Choices will be made, there will be winners and losers. We also see consolidation in play between the current competitors.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!