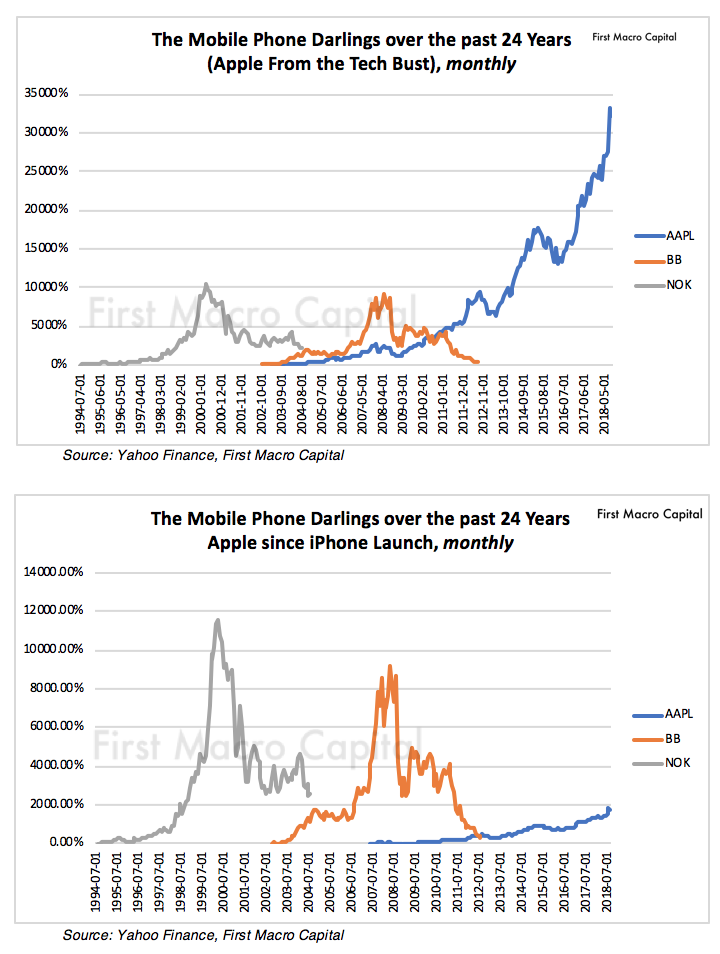

As we enter the end of final innings of the business cycle, some are calling the end of the tech bubble but what about cell phone bubble? Interestingly over the past three business cycles, we have had three very different cell phone leaders. Nokia in the 1990’s, Blackberry in the 2000’s and Apple during the 2010’s. As we enter the end of the business cycle, will Apple & Samsung be able to hold onto their dominance as we prepare for the transition of the new generation of phones?

Is Smartphone Fatigue Setting In?

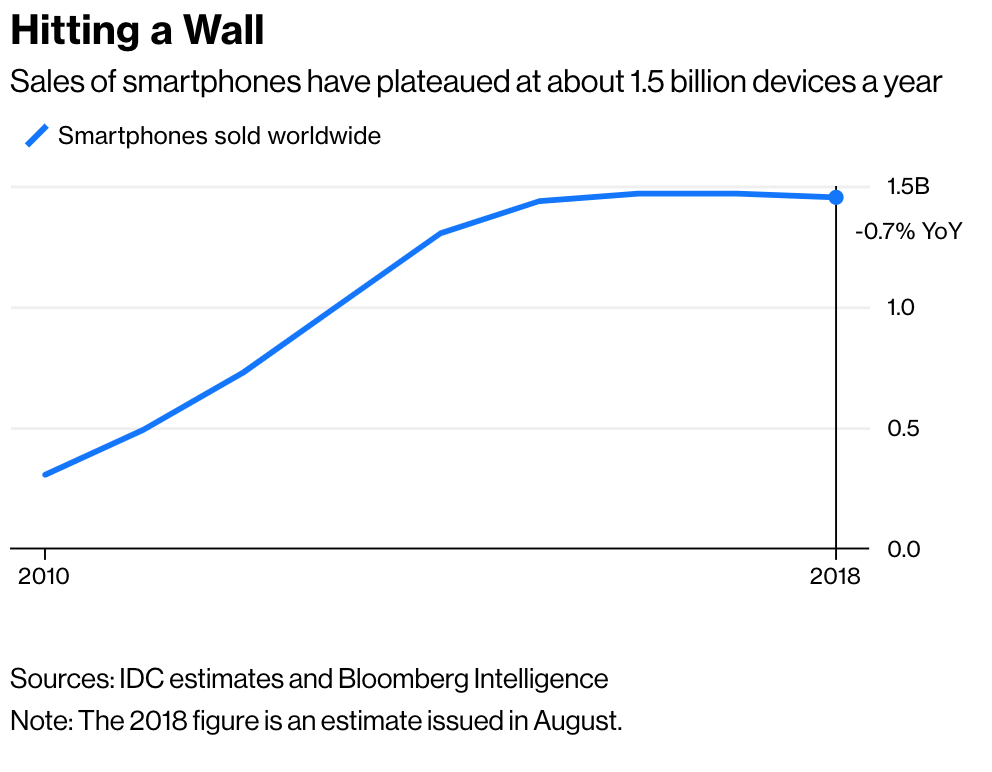

In the biggest smartphone market, “Smartphone shipments in China suffered their biggest ever decline in Q1 2018, down by more than 21% annually to 91 million units, a number first passed some four years ago in Q4 2013” as per Canalsys. Overall global demand is slowing, and the fall in demand will accelerate as the current business cycle comes to an end. But what about the design of them, can consumers tell the difference?

PEAK DESIGN?

Not only is smartphone sales slowing, but we are running into peak design issues.

Reminder from BlackBerry in April 2008

One year prior to the 2008 Crash, in June 2007, the Apple iPhone was launched and here was the reaction from the two Co-CEO’s of Research in Motion (now BlackBerry), the leading smartphone manufacturer at the time.

“Apple’s got a better deal,” Mr. Balsillie (Former Co-CEO of BlackBerry) said. “We were never allowed that. The U.S. market is going to be tougher.”

“These guys (Apple) are really, really good,” Mr. Lazaridis (Former Co-CEO of BlackBerry) replied. “This is different.”

“It’s OK—we’ll be fine,” Mr. Balsillie responded.Source Forbes

Ten months later in April 2008, and a few months before the crash, Mr. Balsillie was conducting an interview and was asked about the Blackberry device:

Host: “Do you get the sense at this point with the BlackBerry itself, that device has done for your company. That it’s a matter of time before people…like the iPhone didn’t really do it. [Do you ever wonder] what are we going to do, if this isn’t our primary business growing beyond the BlackBerry.”

Jim Balsillie: “Roughly, die. We are very poorly diversified portfolio. It either goes to the moon or crashes to the earth. But its making it to the moon pretty good. Totally Stay With it” Source

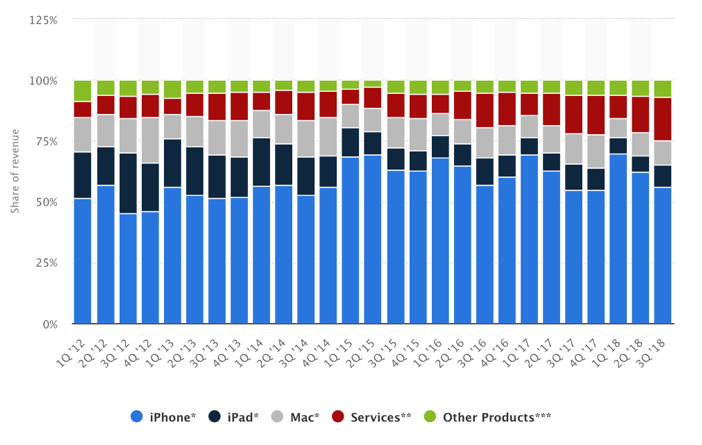

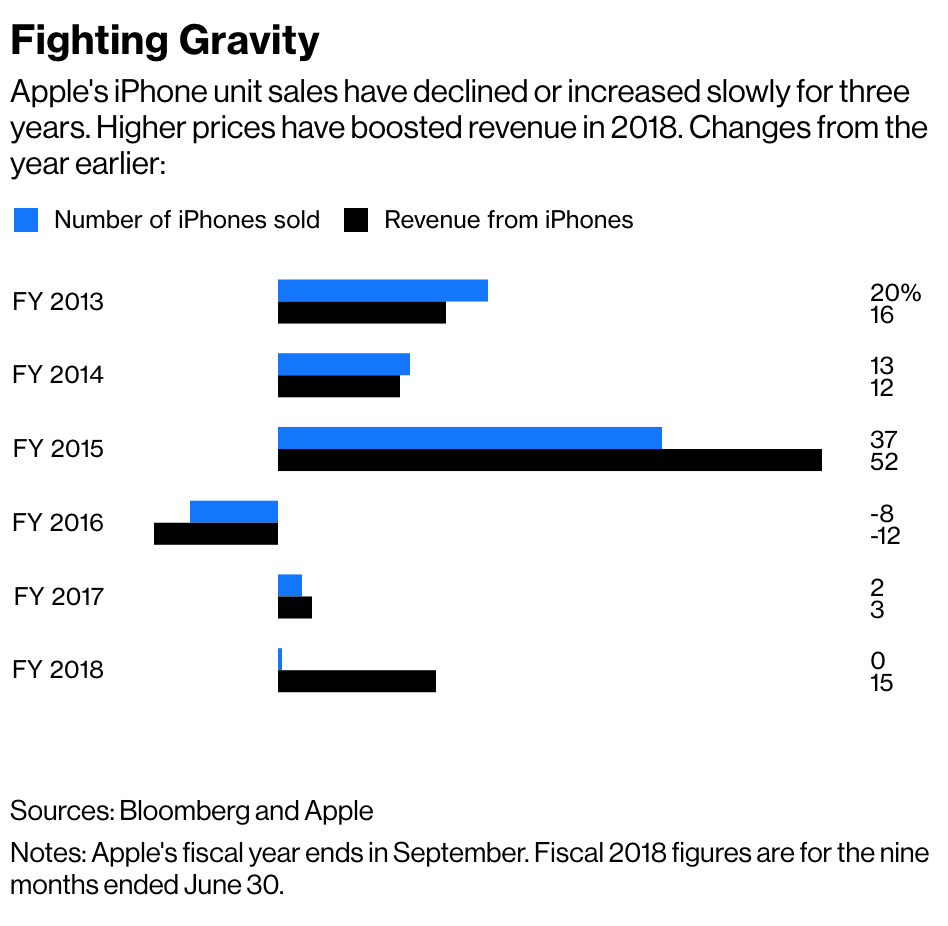

Here is a look at Apple sales for those wondering:

Apple Services is comprised of Digital Content and Services, AppleCare, Apple Pay, licensing and other services”. Much of the Apple Services is tied to the usage of the iPhone. Higher prices have been helping Apple in the near-term, but what happens when demand slows?

Will You Be Staring At A 2010 Phone?

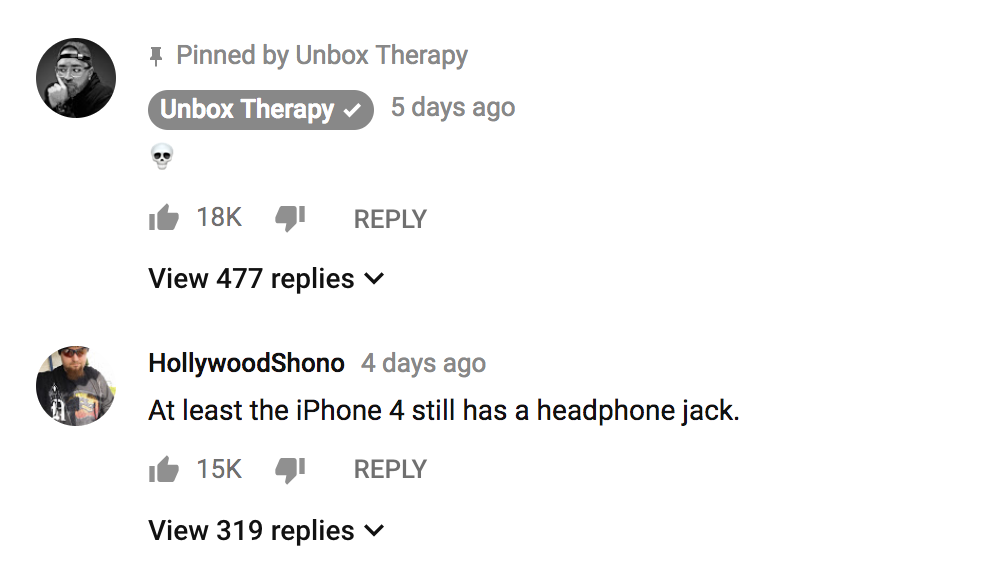

According to Unbox Therapy, the iPhone 4 was launched in June 2010, has the same number of pixels per inch as the 2018 iPhone 4 priced at $749 USD. Eight years later, iPhone 10R has the same screen resolution of a ten-year-old phone.

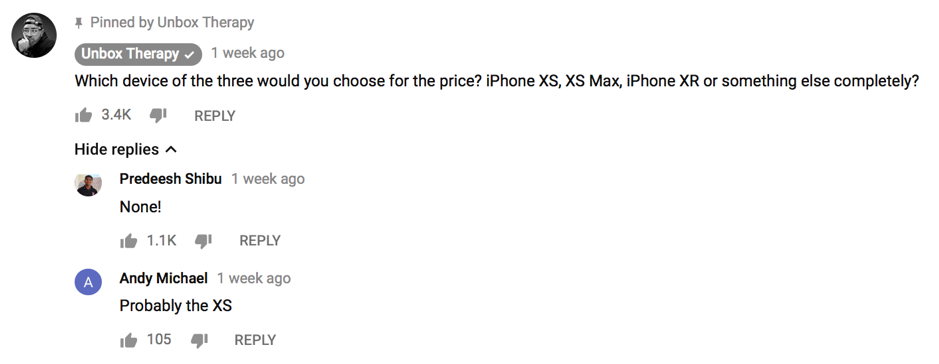

But more importantly, what are the potential customer comments, and do they agree with Lewis?

Here is from another YouTuber: “For the first year ever, I am not buying the new iPhone” – SnazzyLabs

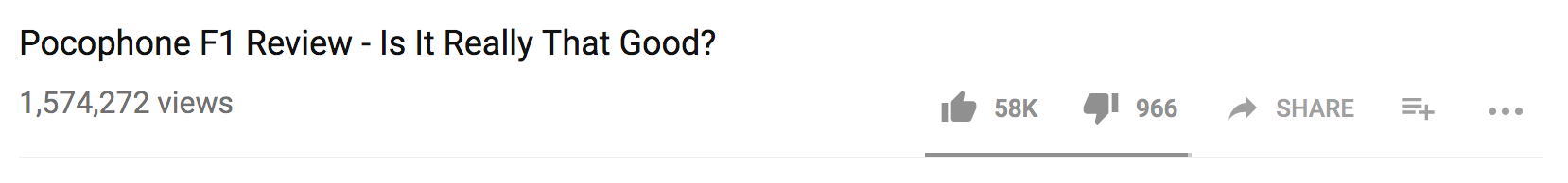

The device that could chip away at Samsung & Apple

“You don’t expect this for $299 starting price? I haven’t had nowhere near the number of tweet for a particular device.” Unbox Therapy

“Does it change the game enough to make you think twice about buying a premium phone at a premium price? Smartphones at this price are getting really good.” Unbox Therapy

The approval rating from potential customers on this video is more than 98%.

The approval rating from potential customers on this video is more than 98%.

Is the Tide Starting to Turn on Apple?

Will iMessage Save iPhone?

One of the main reasons main users say they won’t switch from Apple is because of the ecosystem. But if you dig a bit deeper, they say its iMessenger. Does it sound familiar to BlackBerry users who would never switch because of BBM (BlackBerry Messenger)? With the proliferation of Whatsapp, Snapchat, WeChat, Viber, we think holding onto an iPhone because of the iMessenger, isn’t a strong enough moat.

As we enter the 5G phones and the end of the business, will Apple & Samsung be able to hold onto their dominance as we prepare for the transition of the next phones? History shows that investors may not treat the leaders positively in the next business cycle, as new innovation is brought in by smaller players.

Biggest Risk is Demand Concern

Goldman Sachs estimates Apple is only expected to grow 5% in 2019, this is down from its 12% sales growth estimate for 2018, and down from 10% in 2017. Will Apple and Samsung be able to be at the top of the leaderboard for the next wave of phones? What happens to the estimates if tariffs are applied to the iPhone? How will that impact Goldman’s and the rest of Wall Street’s estimate? The biggest risk is a demand problem. Apple still is an iPhone business, because consumers will purchase MacBook’s and use its services because of the iPhone. What about Samsung? What happens when demand falls because like all electronic devices, they inevitably will? Will Apple & Samsung break the cell phone curse?

Will these famous last words be repeated?

Jim Balsillie: “Roughly, die. We are very poorly diversified portfolio. It either goes to the moon or crashes to the earth. But it’s making it to the moon pretty good. Totally Stay With it” Source

LONG-TERM BULLS – WARNINGS FROM STEVE JOBS

“If you were product person, you couldn’t change the course of that company very much. So, who influenced the success of Pepsi-Co? The sales and marketing people. Therefore, they were the ones that got promoted and ran the company. For Pepsi-Co that might have been okay. But it turns out the same thing can happen in technology companies get monopolies, oh, like IBM and XEROX. If you are a product person at IBM or XEROX, so you make a better copier or better computer. So what?!. When you have a monopoly market share, the company is not any more successful. So, the people that can make it more successful are the sales and marketing people and they end up running the companies. The product people get driven out of the decision-making forums. The companies forget what it takes to make great products.

The product sensibility and the genius that brought to them to the monopolistic position, gets rotted out by people who have no conception between a good product versus a bad product. They have no conception of the craftsmanship required to take a good idea into a great product. They really have no feeling in their hearts to really help the customers, so that’s what happened to Xerox.

The people that used to work at Xerox, used to call the people that ran it, toner heads.”

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!