Question: Do you think Gold will go to $5,000, over the next few years, as some are predicting gold will hit $2,000 in the next 2 years?

Thanks!

Response:

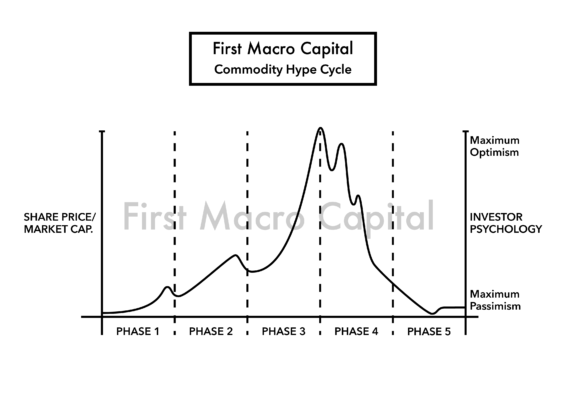

The biggest mistake most retail and professional investors make, when investing in the any sector, particularly the commodity investing, is understanding the cycle of a sector. Some sectors follow the business cycle, like real estate, industrial manufacturers, industrial commodities, and retail discretionary spending. Then there are those that have longer cycles, like healthcare, which are less tied to the business cycle, and more linked to the cycle of government spending. But what about gold? Where are we in the cycle?

Where is gold in the First Macro Capital Commodity Hype Cycle?

Most investors blindly assume gold prices are going up forever, and fight the price action, all while it is going down. I was one of them, that is why I spent time to better understand the cycle of the commodity sector and created a free report for investors. Admitting you are wrong is the first step to being a better investor. By understanding the past, you can better understand the future. Most people assume that their situation is different, and that what happened in the past, won’t happen to them. This is dead wrong thinking. I was fortunate to learn my lesson and buy wonderful businesses at their bottom.

What happened in the 1970’s

What happened in the 1970’s

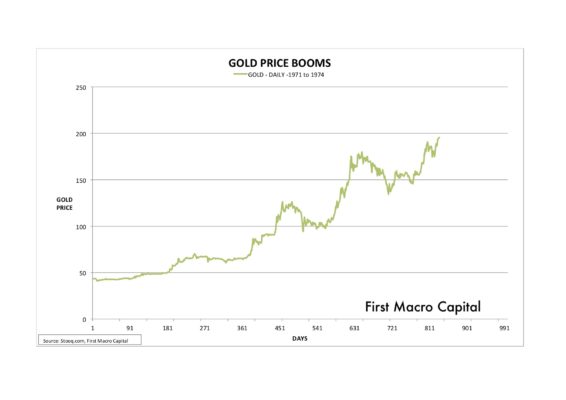

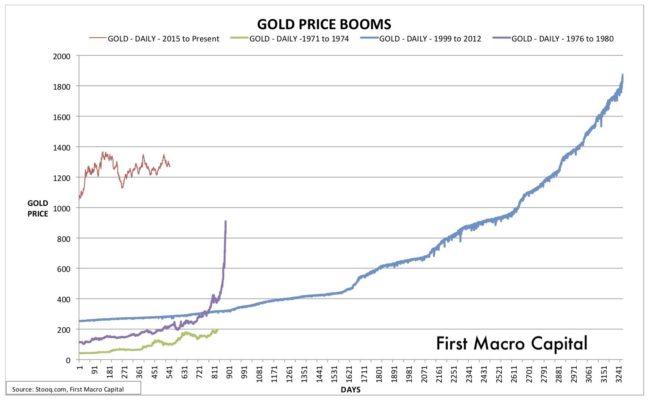

The critical event in the 1970’s was the Nixon Shock, when President Nixon de-pegged the dollar from gold. From the Nixon Shock to the peak in 1980, the cycle lasted 2,103 trading days, or always 10 years.

Boom 1 – 1970’s (1971 TO 1974)

There were two booms, in the 1970’s. You may say, “No, there was 1”, but remember the peak in 1970’s? Gold went up 22 times from 1971 to 1980. Yes, I do remember. But there was a bear market half way through the 1970’s that washed out investors, with a more than 20% drop.

A bear market starts, when the price falls, 20% from its high. A bull market starts, when it has broken above the price at which it is 80% from its last high. The retail and media definition is when the price is 20% above its low.

The gold price increased by 4.8 times from the Nixon Shock. This was followed by a steep drop from 1974 to 1976, where the price of gold dropped46%, sowing the seed for the next boom. Yes, 46%!

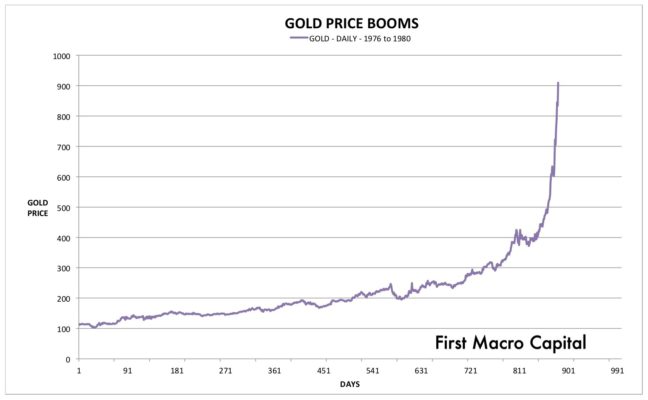

Boom # 2 of the 1970’s

This is probably one of the most famous gold price moves, because interest rates are rising, inflation was rampant. From 1976 to 1980 the price increased 8.9 times from the bottom of the bear market in 1976 to the peak in 1980, when interest rates famously peaked. It may be so famous, because the rise happened in such a short period of time. Again, this boom was related to the confidence in the ability to pay the debts. The price action in gold had two 10% or more moves down. If one over-leveraged on the way up, one would have been washed out, and passed to strong financial hands.

What happened in 1999 to 2012?

As the NASDAQ peaked for the Tech Bubble 1.0, gold was bottoming. This was around the capital flows were heavily invested in technology stocks particularly retail investors. As the peak turned capital flows turned out of technology and into commodities (oil, silver, uranium), not just gold. The price of gold increased by 7.53 times over 3,200 days.

With the rise of the BRIC’s, China and Russia became significant buyers of gold during this time and a decline in the dollar, as capital flowed out of the United States from the tech boom into these rapidly growing countries. Resulting two key factors for the rise of gold for an extended period of time..

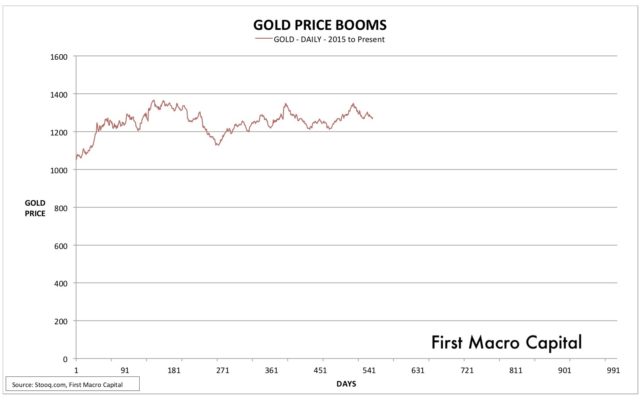

Where are we right now from 2015 to Present?

The current length of the gold cycle is just over 540 days, from the low set in December 2015. That being said, the price of gold is up about 1.3 times. We are still early on in the price action of gold based on what past history tells us. There is time to build positions.

How does the current cycle compare to the other past gold booms?

If history is a lesson to the future, we still have some time before things start to get more exciting. We are only at the half way points of the 1971 and 1976 boom, and less than 15% through the 2000’s boom.

Those using financial leverage to invest in the space, should be prepared for financial swings, so they don’t get pushed out of their positions. This could very well happen. We will need catalysts from the bond market, as interest rates rises, and bond investors seeking alternatives to their bond portfolio that will be under pressure.

A few lessons from the past gold booms, is that the price of gold went up between 4-8 times the bottom of the gold. Which presents the current gold boom to go up to $4,000 to $8,000, in US dollar terms. In other currencies it could go much higher. This gets a lot of people excited, when they see the gold price potential. More importantly is the days that the gold price will go up to reach those highs. We are only about 50% through the two 1970s cycle, and only about 15% through the 2000’s boom. It could be longer than 900 days.

A few lessons:

- It is important to look at the past to see how long it took past booms to unfold, so you can better match your investing time horizon with the actual investment.

- If you don’t position size your position correctly, when using financial leverage for an investment, you could get pushed out of your position on the up to be able to enjoy the full-ride.

- Looking at the past helps understand the future, and put the “hype” into more particular terms, so you can continue to do other more important things in life, than speculating on the price upside.

- It is important to know where you are in the cycle, this helps you better determine, where you are in the commodity cycle and what to do or not to do about it.

- The final price high could take longer than you imagine, patience is the lesson to reap the rewards of the benefits.

Where do you think gold will go? How long do you think it will take to get there?

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!