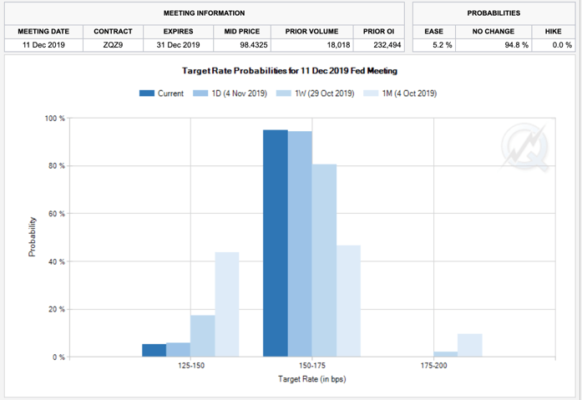

Since the most recent rate cut, we have seen the probability of further interest rates cuts by the US Federal Reserve swing from almost a 50% chance of further rate cuts in December, now to a 5.2% chance of further rate cuts from the Fed. Essentially the market is pricing in no further rate cuts. What does it mean for the yield curve? What does it mean for gold, gold stocks, and the S&P 500?

Consumer Confidence – Rates – Unemployment

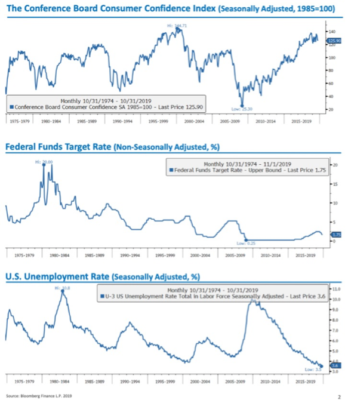

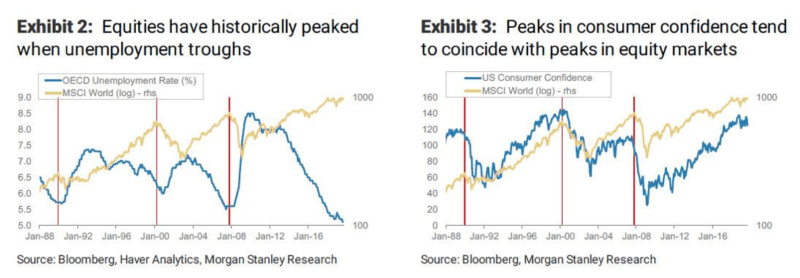

Once Consumer confidence peaks, we get further rate cuts, and then unemployment rises. What does consumer confidence tell us about the market?

All Eyes on the Consumer

When we look at the Conference Board Consumer Confidence Index, it commonly PEAKS, when the stock market is peaking, and then in the following weeks and months, as the unemployment rate is troughing, we begin to see the unemployment rate start to accelerate.

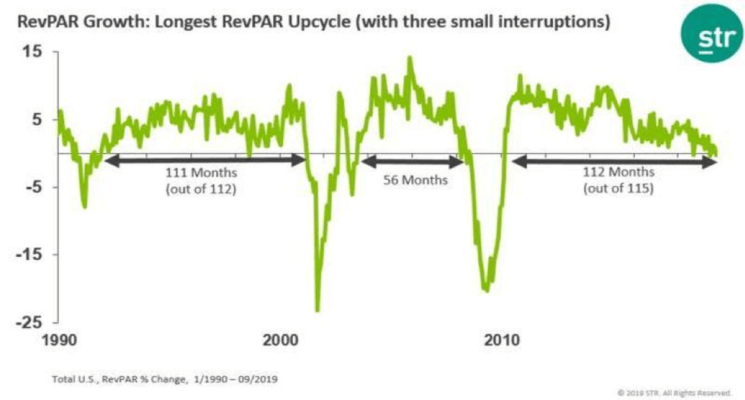

Hotel Industry

Let’s look at one key leading indicator in the hotel industry that reflects spending by both consumers and businesses. “As HotelNewsNow reports, In September, US hotels recorded the second monthly revenue-per-available-room decline of 2019, declining by 0.3%, as average daily rates increased by 0.6%, but that was not enough to overcome the 0.9% occupancy decline.” Occupancy in the US has declined for three of the past 4 months. Is the hotel demand highlighting further slowdown in consumer spending?

FED RATE CUT, YIELD CURVE, and GOLD

Historically once the Fed rate cuts enough to fix the yield curve from being inverted to no longer being inverted, just like in 2001 and 2007, we saw a recession in the following months ahead. We don’t think this recession will be as severe as 2008 because we don’t want to get caught up with anchoring to the most recent recession. Gold has outperformed the S&P 500 when the US 10 Year minus the US 3-month was no longer inverted because of the fed cutting interesting rates. Now we are back to where we were in 2001 and 2008, with our preference to be overweight gold relative to the S&P 500. Gold in these environments relative to the S&P 500, is poised to outperform.

Gold or Gold Stocks

What about gold versus gold stocks? Depending on your time horizon, gold stocks are positioned to outperform gold in the coming years. That being said, in the near-term gold stocks may be impacted if the entire market sells off, but we would expect them to bottom much earlier than the S&P 500 as the materials sector tends to outperform in the early stages of the new business cycle. Gold and gold stocks will bounce around, with gyrations. The bottom is in for gold stocks relative to gold when the ratio bottomed in 2016. For the long-term investor, holding on here is most important to generate multi-bagger opportunities.

Gold Stocks vs S&P 500

Important, the US Dollar peaked in 2002, resulting in gold stocks outperforming S&P 500 in the coming 12-18months. Gold stocks are back to their 2002 lows versus the S&P 500, and if you are willing to take a 12-18 month view, it looks increasingly probable that gold stocks will outperform the S&P 500 as gold stocks head higher and the S&P 500 falls. The US dollar weakens and the rotation out of tech (largest sector of S&P 500) into commodity stocks. The world is presenting a gift to investors and those looking for new asymmetric opportunities.

“You can hate if you want to, but you’ll be with me in time” – Rev. Run

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!