Pot Stocks have been all the rage for the past couple of months in the U.S. & Canada, because Canada is doing a countrywide legalization of recreational marijuana, on October 17, 2018, just days away. But could October 17, 2018, be a sell the news event? What happens after that? We will see which companies are prepared and which are not ready. Those companies that have said what they said they are going to do, will further reward shareholders. Then there are those that have been overhyped and overpromised. There have been an incredible amount of celebrations recently in anticipation of the event. But the reality is going to set in very quickly and CEO’s and analysts are making cautionary statements before the day. Will there be tears?

CEO’s & Analysts Warning in Advance

Before the official launch, we are already starting to hear some cautionary statements from Analysts and CEO’s:

“The market isn’t fully online immediately,” Cronos Group Inc. Chief Executive Officer Mike Gorenstein said Sept. 27 at a CIBC investor conference. “The first year is soft a soft launch.” (Bloomberg)

Jim Cramer, paraphrasing what Bruce Linton (CEO of Canopy Growth) told him

“Even though there is going to be legalization next week don’t expect there is going to be this gigantic explosion of sales in Canada because it’s not going to happen.”

Linton: Yes. So, what is going to happen, is October 17 is the first-day Canadian adults, 19 and older can actually go to a store legally buy cannabis. I think there will be a lot of lineups and a lot of sales. Then there will be October 18, then November 18 and this will start to become a bit more normal platform”

“It will be a fairly thin market to begin with and maybe that’s why a lot of these provinces haven’t rushed to get retail locations and bricks and mortar for day one…I would expect there to be long waits and very limited product types.” PI Financial analyst Jason Zandberg ” (Bloomberg)

“There just isn’t that much product that’s going to be available day one,” said Zandberg. (Bloomberg)

BIG Supply Tsunami Coming in 2019

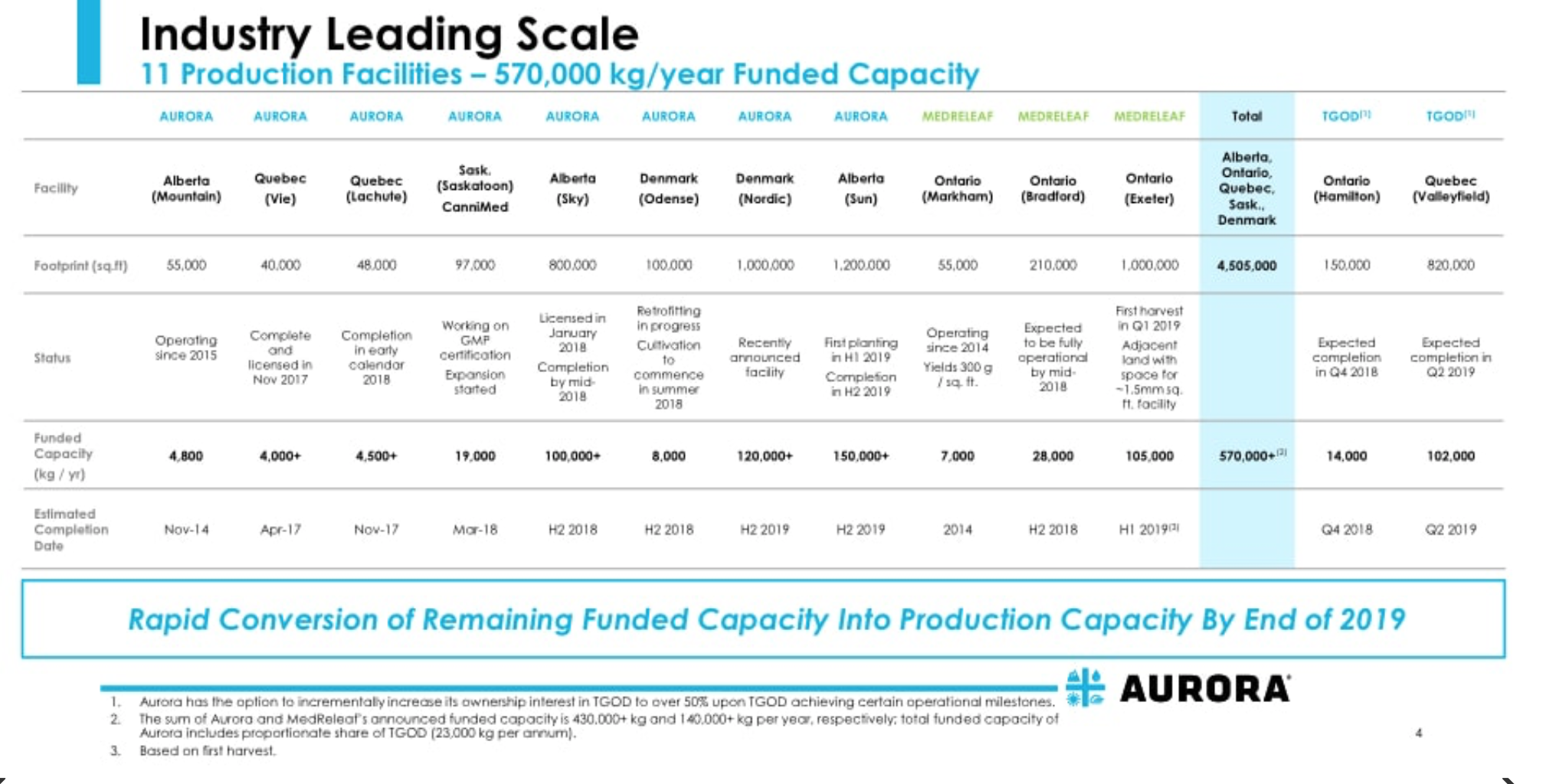

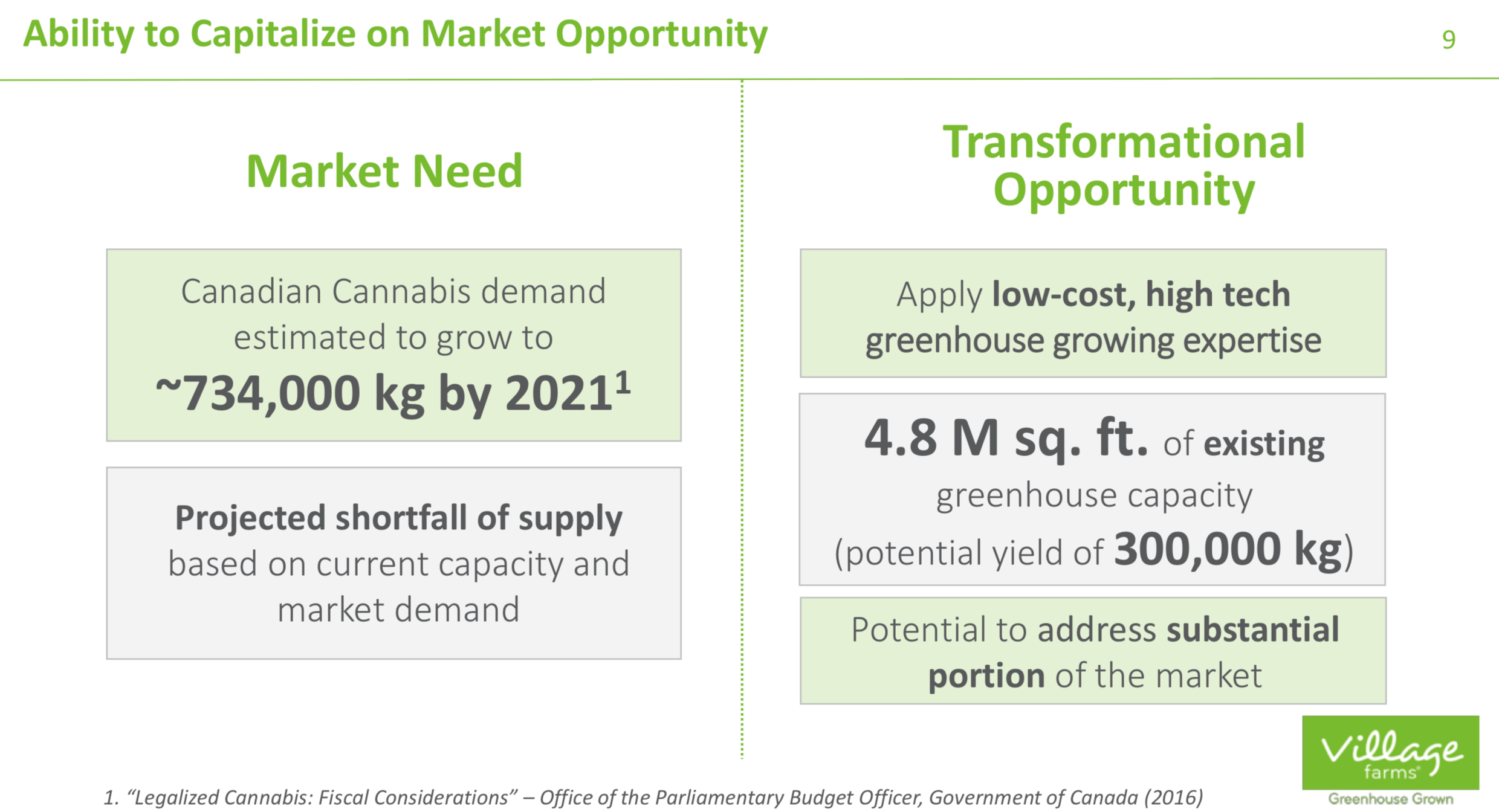

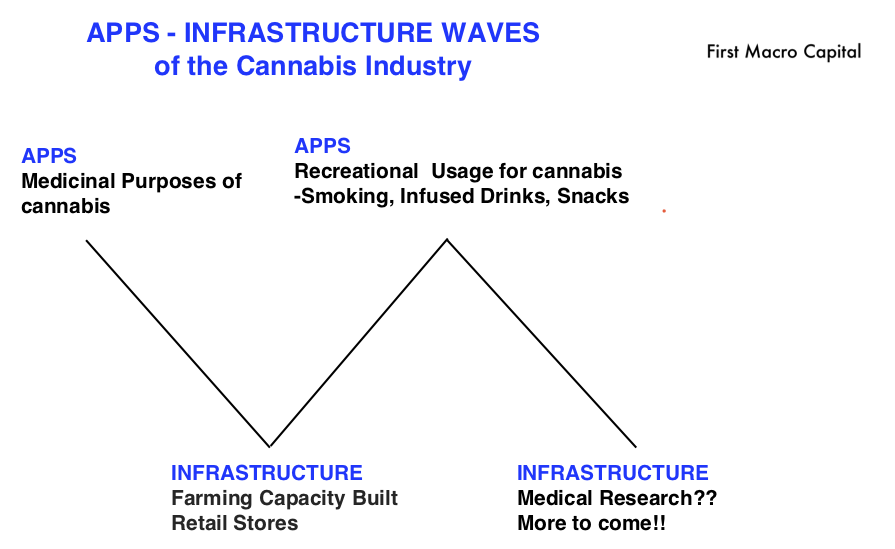

This first phase of the pot cycle, we view as the buildout of production capacity, similar to infrastructure buildout of the internet when cables were laid across countries, buildout of infrastructure for railroads, or the solar panel buildout. Infrastructure buildouts have a long history of booms and busts in sectors. Today’s pot cycle is building the greenhouses for the wave of long-term growth of the sector, which we agree is there, but this short-term supply buildout by producers should be a red flag to investors, which only includes the main producers providing guidance and capacity and doesn’t include the producers that have only just started planting. Opportunities to buy companies below replacement value will occur.

“By the spring of 2019, I’d say April or May of 2019, we will be producing over 20,000 kilos a month. That’s enough to serve 50 per cent or 40 per cent of projected recreational use in year one in Canada,” Neufeld said (CEO of Aphria) National Post.

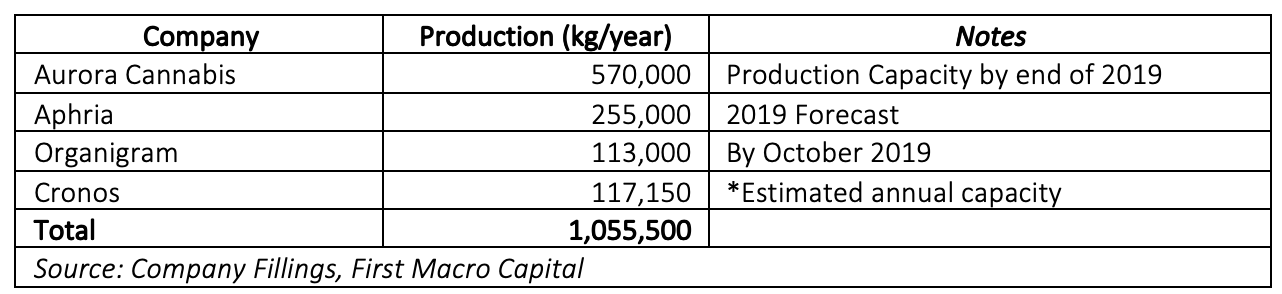

If Aphria assumes they can supply 40-50% of the market in 2019, and yet Aurora Cannabis is expected to more than double the production of Aphria. We haven’t included the production of Canopy Growth, nor have we included production for the smaller producers. The simple question remains, where is all the crop going to go????

We agree there is an offshore opportunity to ship the product to overseas markets, but will the demand be able to absorb all this crop? Just like in mining, and other sectors, the producers eventually always oversupply in a commodity sector.

Even More Production Coming Online

There have been currently about 120 licenses to cultivate marijuana, but they have just started to grow the crop. What happens, when this production comes online in 2019 from the producers? We think supply-demand dynamics will correct itself and will be more felt by farmers in 2019 when reality sets in on the true demand and true supply.

What would happen if this potential capacity comes on as well?

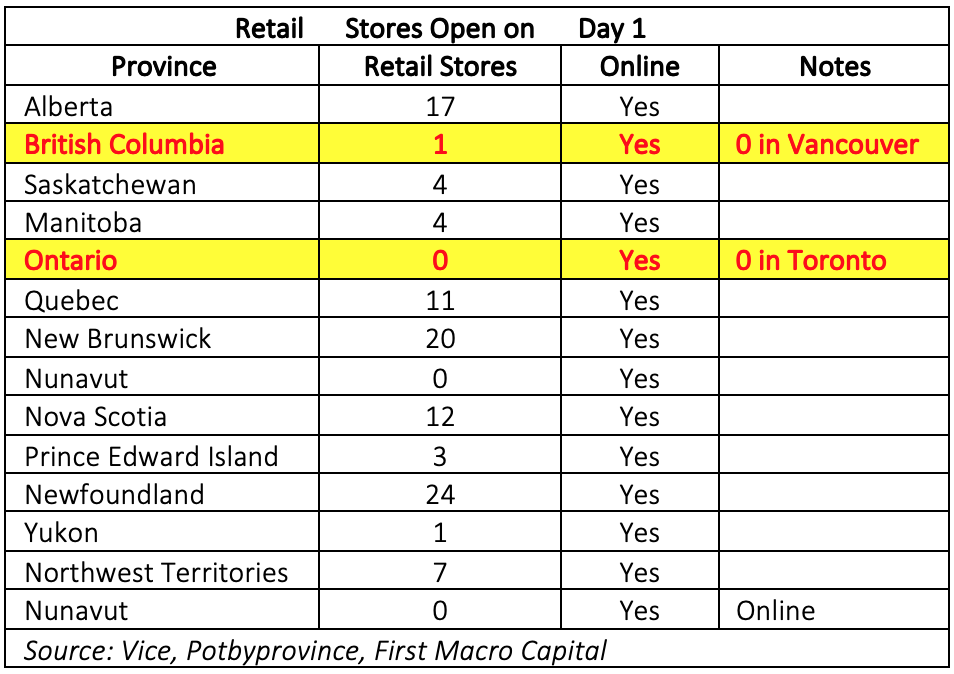

All the Supply – With Few Places To Buy on Day 1

In two of Canada’s biggest cities (Toronto & Vancouver), there will be 0 retail stores available to purchase products on October 17, 2018. It will all be online until the stores get built.

In Saskatchewan: “We know that not everyone is going to be ready for Oct. 17th,” said SLGA (Saskatchewan Liquor and Gaming Authority) spokesman David Morris.

Scenario’s That Could Happen Beyond Day 1

- Long lines are shown on the media because there are only a few stores open.

- People coming in from the United States into Canada

- Consumers traveling inter-provinces because provinces like Ontario doesn’t have any stores yet

- Travel tourism packages for those interested in it.

- Large corporates coming in to acquire large M&A may single a short-term bubble

- Consolidation within Producers (Farmers)

- New countries to approve recreational cannabis because of the HUGE tax windfall.

- Bankruptcies for pot farmers that leveraged up their balance sheet in commodity business when supply is expected to grow faster than demand. High-cost producers with high debt load will feel the pain.

- Opportunities to buy capacity when the dust settles below replacement value.

The Current Pot Sector Has All the Characteristics of Being A Mania

- Price Doesn’t matter for the stocks paid by investors

- Too few stocks

- Main Street Chatter

- Spike and top

- An Underlying Truth Behind the Theme

- Marijuana is not going away

- Government regulation that opens up a sector for Investment

Cramer: “You have even said, this is a bit like the dot-com, there were some survivors”

Linton: “Right”

Cramer: “but frankly you are the only one that has a lot of capital.”

Linton: “Why would you try and create this into a promotion company, where you might make a short-term enrichment in stock? When you can actually become a globally dominant company and do something interesting for a decade or two”

Larysa Harapyn, Financial Post: Some investors have likened this to the cryptocurrency craze.

CannTrust president Brad Rogers, CEO: “There is froth. There is a lot of people very interested in it and don’t know where to put it. It’s a consumable. That’s the difference. It’s not software. It’s not the dotcom boom. It goes across the world in many different formats.”

As Howard Marks would say: “Too many people, going after too few deals”

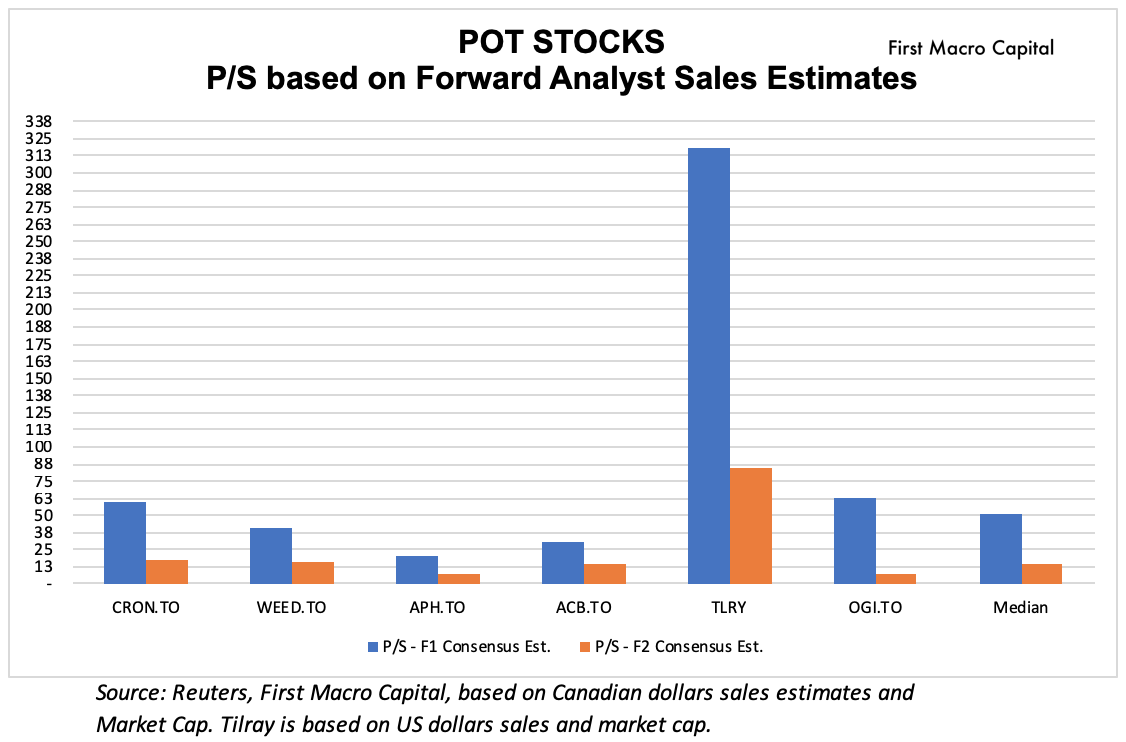

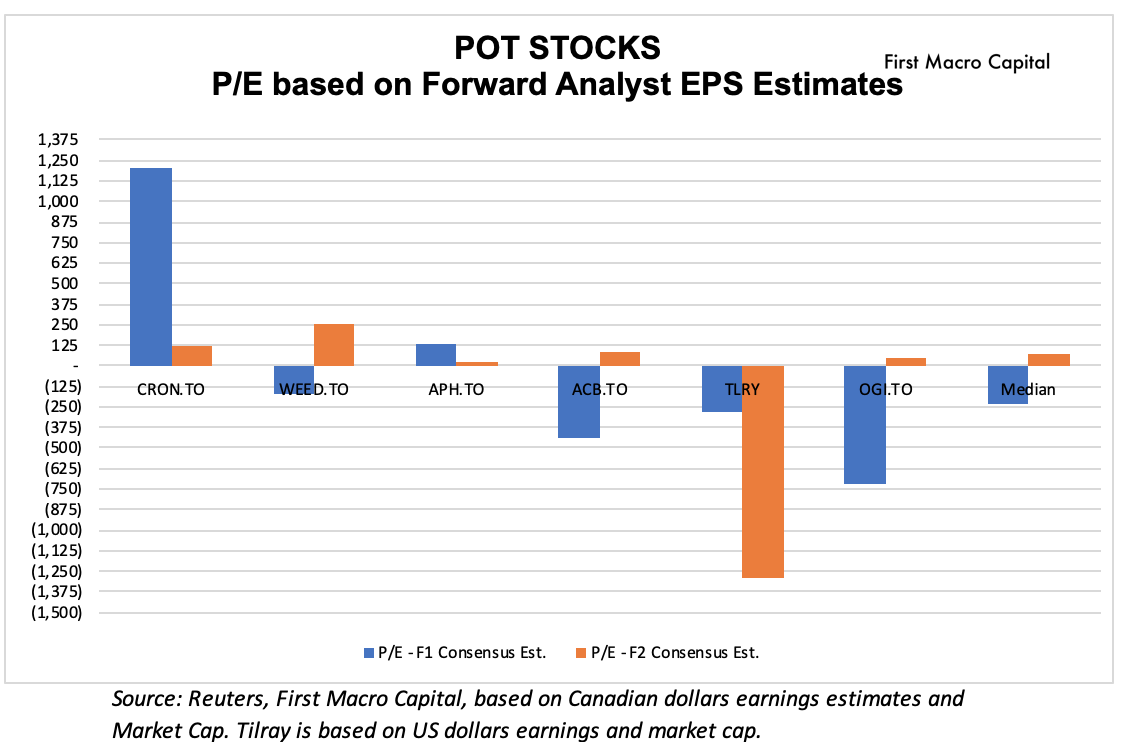

VALUATIONS to the MOON

While we agree with the long-term theme for the cannabis sector, valuations have gone parabolic because since U.S. investors have entered the party, there are too many investors, chasing too few deals. Investors have been chasing four stocks on the U.S. mainboards (Canopy Growth, Tilray, Cronos, and G.W. Pharmaceuticals). There is potentially two more joining the group with Aphria and Aurora Cannabis rumored to up-list on the U.S. mainboards on either the NYSE & NASDAQ. Valuations for these mainboard stocks are stretched. Explosive sales growth that is expected by speculators may significantly disappoint when reality sets in, particularly as CEO’s are giving cautionary statements of sales estimates. Valuations on a P/S sales will come to a realistic base.

Prices Falling Ahead of The Open?

Prices Falling Ahead of The Open?

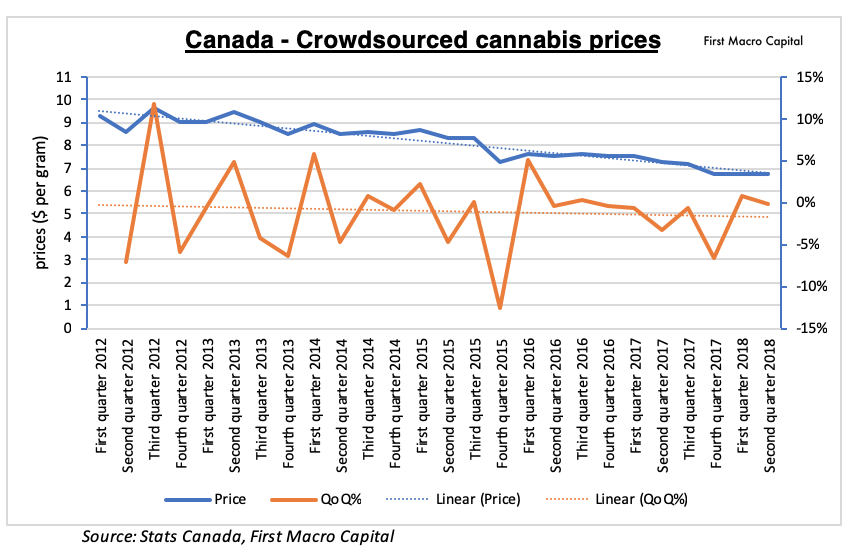

Cannabis prices have been in a downward trend since 2012, and prices have only gone up in 7 of the past 25 quarters. We think in the very, very near-term, there may be price spikes because of limited store openings and potentially online delivery issue. But, what happens when the supply comes online?

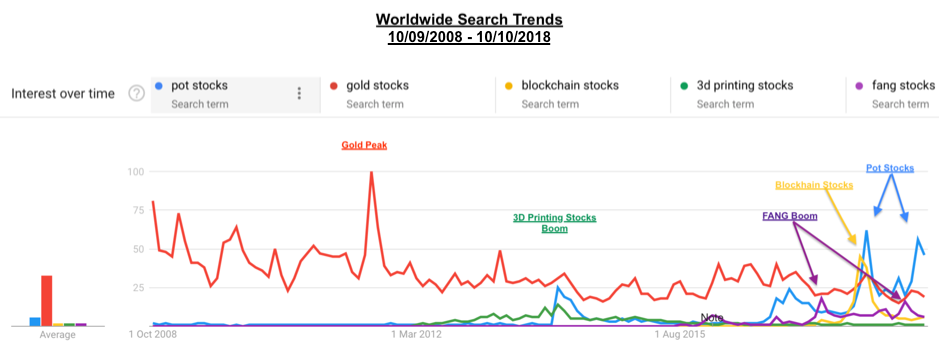

Investors Left Holding the Bag

Google Trends highlights over investor interest in pot producer stocks, may have peaked going into the big day for the Canadian stocks. Historically a peak in Google interest may highlight the euphoria is ending, and cool down is in place. Pot stocks have only done what FANG stocks have done, and peak twice in terms of interest. The long-term trend makes sense, just like the internet infrastructure buildout during the dotcom boom, or 3D printing, or the cell phone providers boom. The cannabis producers today are laying the groundwork for new applications of cannabis usage because the cost of marijuana will come down and the regulatory burden will continue to fall.

M&A

Big Tobacco may be a consolidator in the industry as they try to offset substitution to marijuana, along with new customers they never had before. The alcoholic beverage sector may consolidate production capacity or buy into producers of cannabis-infused products. There are also the beverage manufactures that will look to acquire a producer, to add new growth into their portfolios. It will once again create a new mania, as there are too few companies of considerable scale yet more than enough potential buyers from both the big tobacco and beverage sectors that could easily acquire one of these businesses. The CEO’s waiting to see how things play out before the launch and how the supply is impacted.

Known Unknowns

- No one knows what the true demand will be

- Farmers do not know how much supply will truly come online in 2019 that will impact prices

- No one knows how long it will take to get stores opened in the major cities across the country

- Will the U.S. start to reject Canadians at the borders?

What’s After The Infrastructure Bust? Application 2.0

This first phase of the cannabis sector is bringing on the production to meet the consumer demand. What does the second phase of the pot applications look like?

“We disrupt alcohol potentially, cigarettes potentially, in terms of smoking cessation,” he (Canopy Growth CEO) told Cramer. “We really disrupt pharmaceutical, because whether or not you’re geriatric care, you’re dealing with arthritic conditions, you’re someone who can’t sleep, you’re going through an oncology treatment, I think you’re going to find cannabinoid therapies really hit there.”

“And so you add all that together, plus the existing $200 billion illicit market, that pretty quickly gets you up around $500 billion,” Linton continued. “It sounds like a ‘How could it be?’ but just do a bit of the back-of-the-envelope math. It’s not crazy.“

“The DEA-approved partner, which we haven’t announced yet, can actually begin to do medical research, clinical trials if necessary, [and] create the data set that enables people to know when, what, where, and maybe it can become federally regulated in the U.S. with some input that way,” Linton said in an interview on “Mad Money.” –CNBC

As any investor in biotech knows, this medical research and clinical trials that we have included in the second phase is building out the research will take multiple years to roll out new products from clinical trials. The snacks, beverage and cigarette side will be more near-term. This second phase will produce bigger winners than this current phase because a lot of capital investment has been made bringing the costs down for future entrants that wish to create products from the supply that is brought online.

Cannabis Phase 1.0

The underlying theme for “pot producer stocks” is not expected to go away but in the near-term, we are witnessing too many investors chasing too few deals. Huge supply coming online in 2019, with expectations that demand will exceed this supply from existing producers and in development producers. While the long-term theme remains in place, just like 3D-Printing, Blockchain, the internet, this current boom in marijuana production is focused on building the underlying infrastructure to grow the crops to be used for a number of recreational and medical products. There will be a few winners and the rest will be in tears.

If everyone knows about the boom in pot producer stocks, and everyone knows about this great opportunity. The remaining question is, who is left to buy?

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!