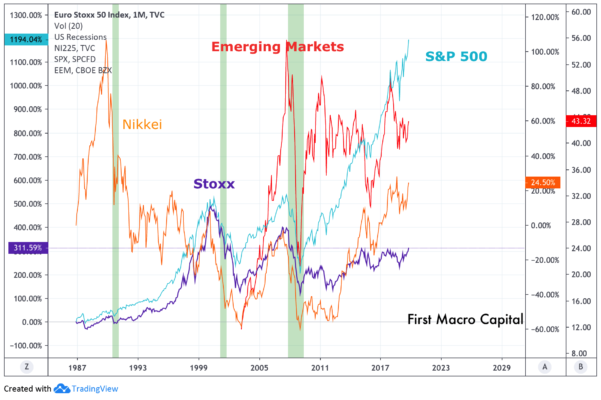

While many are wondering how high the S&P 500 will go. When looking to past decades what happened when all the market’s attention is primarily focused on one equity geography over others? After every major equity bubble, the Nikkei in the 80’s, then Europe in the 90’s, followed by Emerging Markets in the 00’s, each of these equity markets has yet to recover from their peaks. Now to today, is the S&P 500 setting up to repeat? Big Tech is more than 20% of the S&P 500 and the Nasdaq 100. If investors are going to be selling the S&P 500, which is primarily big tech stocks, investors need to buy something else, but what is it?

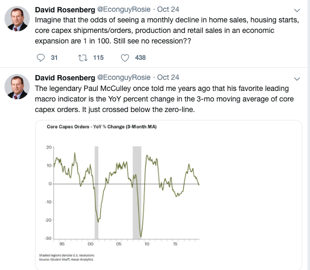

What would indicate a slowdown in the U.S is coming? A slowdown in Core CAPEX orders on a YoY basis is highlighting the peak in the S&P 500 is near, with 2019-Q4 GDP approaching zero.

This all coincides a top in the US dollar.

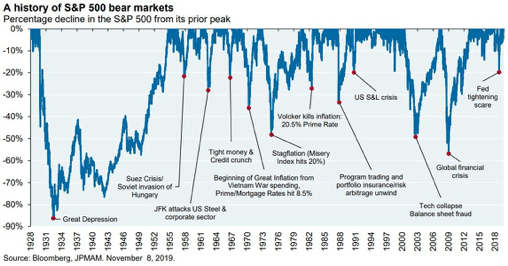

We think this recession will be less severe than 2008 because it is never the same as the most recent recession, where many investors get caught up in recency bias, and with 2008 being a severe recession, we don’t see it in the cards.

During the last commodity cycle, the S&P 500 was essentially flat from 2001-2008 and was down even further when you adjust for a fall in the US Dollar Trade Weighted Index that fell from 130 to below 100 during that time.

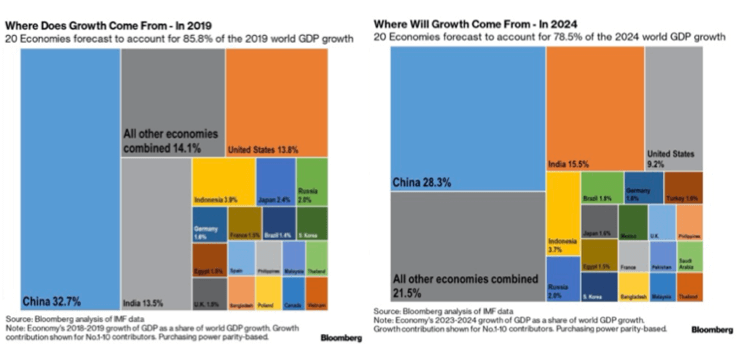

If money flows out of the U.S. as we finish this cycle and enter the next cycle, where will the money go? First off, it’s to the emerging market countries that are expected to power ahead the world growth over the next 4-5.

As we can see here, the US accounted for 13.8% of the world’s growth in 2019, with expectations it will be 9.2% of the growth in 2024.

This is not good for the US Dollar and US Equities.

It is good for commodities countries within emerging markets will surprise investors to the upside because of the rotation into commodities during this time period, like Brazil and Russia.

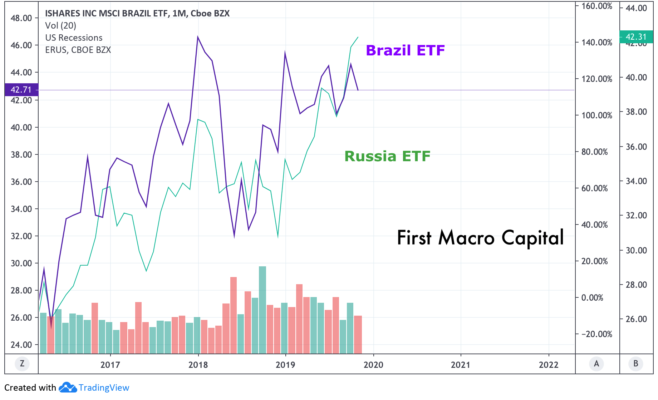

In U.S. Dollar terms, Brazil and Russia have outperformed the S&P 500 since 2016, and we think they are only getting started. Why? Their economies are heavily weighted to commodities and will benefit from an accelerating commodity cycle.

- Could we see this again?

- Even the legendary investor, Warren Buffet was willing to invest in emerging markets during the last cycle.

- Brazil was both the emerging market and a commodity country.

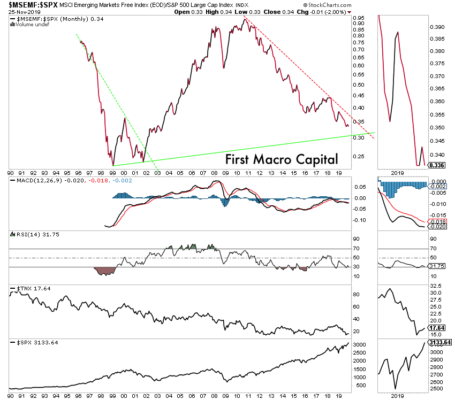

Emerging market stocks are back to their 2003 lows relative to the S&P 500. Emerging markets in dollars terms continues to set higher lows since 2002 after being in a decade of sideways trading, a breakout is potentially coming in 2020. We will let it show us the way to avoid any near-term value trap.

Let’s be clear

- A blow-off top in the US stocks is 100% possible. We are in it, which we let our clients know back in May 2020 that a blowoff top was possible.

- The US equity bubble ending will and a weaker US dollar and will be the catalysts for non-US dollar assets like emerging markets and commodities.

- There is greater upside to emerging markets and commodities.

- If you don’t look at commodities and emerging markets now, because you don’t understand. It will be at least another 20 years BEFORE you have the risk:rewards set up for a once in a generation opportunity.

- The S&P 500 will be the market to avoid in the 2020s, if history repeats, like past equity cycles.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!