There are many who focus on the mining sector being poor places to invest because miners have a history of poorly allocating capital. But there is a segment within the mining sector, particularly the gold sector that many investors miss, is the royalty & streaming model. They are asset light businesses, with teams under 40. They are some of the most scalable businesses in the world. This business model creates more revenue per employee and market cap per employee than any other group in the S&P 500. The Three Gold Kings (Franco-Nevada, Wheaton Precious Metals, and Royal Gold), are the largest royalty and streaming companies in mining.

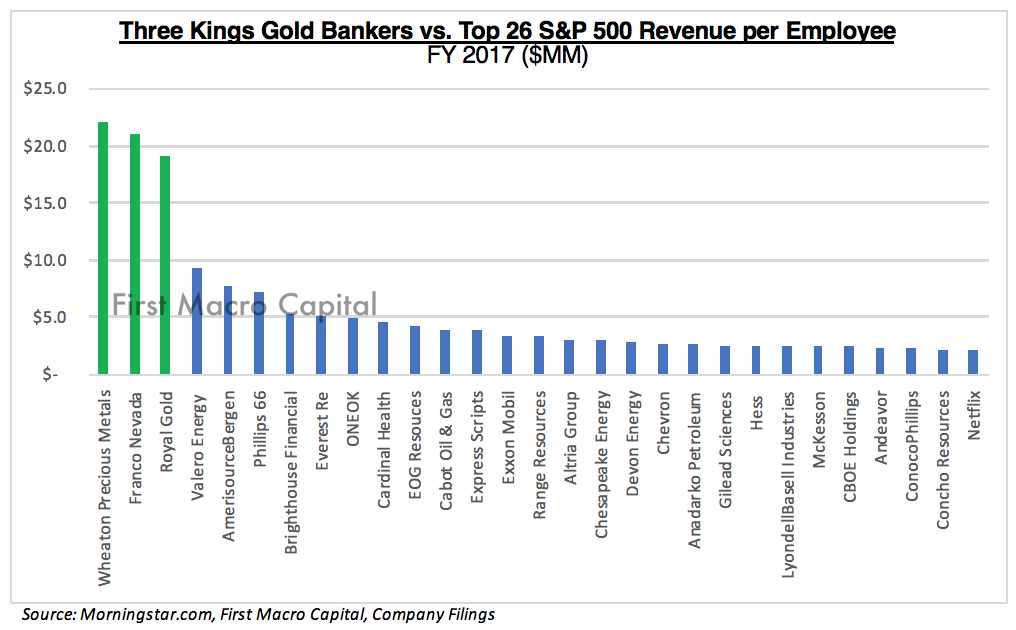

THE THREE GOLD KING vs. S&P 500 COMPANIES (REVENUE/EMPLOYEE)

21 out of the top 50 companies from the S&P 500 that generated the most revenue per employee came from the energy sector. The oil companies saw a resurgence in 2017 because of a recovery in the oil price, accelerating their revenue growth, along with their increased oil production. But, when you compare the top S&P 500 companies on a revenue per employee basis, the top company, Valero Energy, generated less than 50% of the smallest of the three companies generated, Royal Gold. Valero Energy generated almost 60% less than the #1 spot, Wheaton Precious Metals. This is in 2017 when gold and oil produced the similar returns.

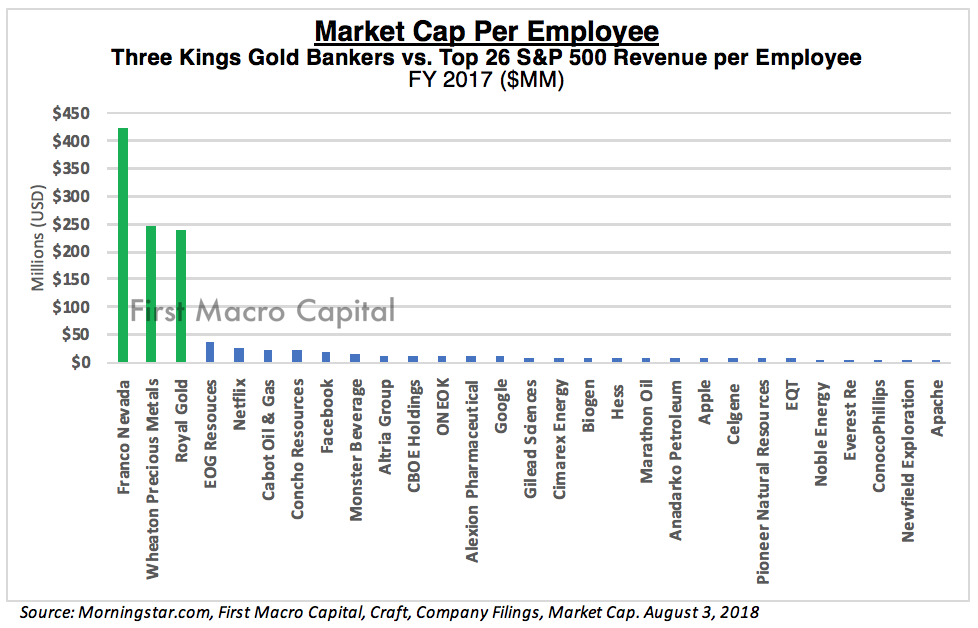

THE THREE GOLD KING vs. S&P 500 COMPANIES (MARKET CAP/EMPLOYEE)

Here is where it gets very interesting when you look at the market capitalization per employee, how do the companies stack up? At the beginning of August 2018, based on the fiscal year 2017 staffing, Toronto based, Franco-Nevada is on a completely different league on a market capitalization per employee at more than $400 million in market capitalization value per employee. This almost 2X more than its nearest competitors (Wheaton Precious Metals and Royal Gold), and more than 11X more than EOG. Apple, the world’s largest company, it’s per employee value was less than $8.3 million in market cap value per employee in 2017, or 97% less than each employee was to Franco Nevada.

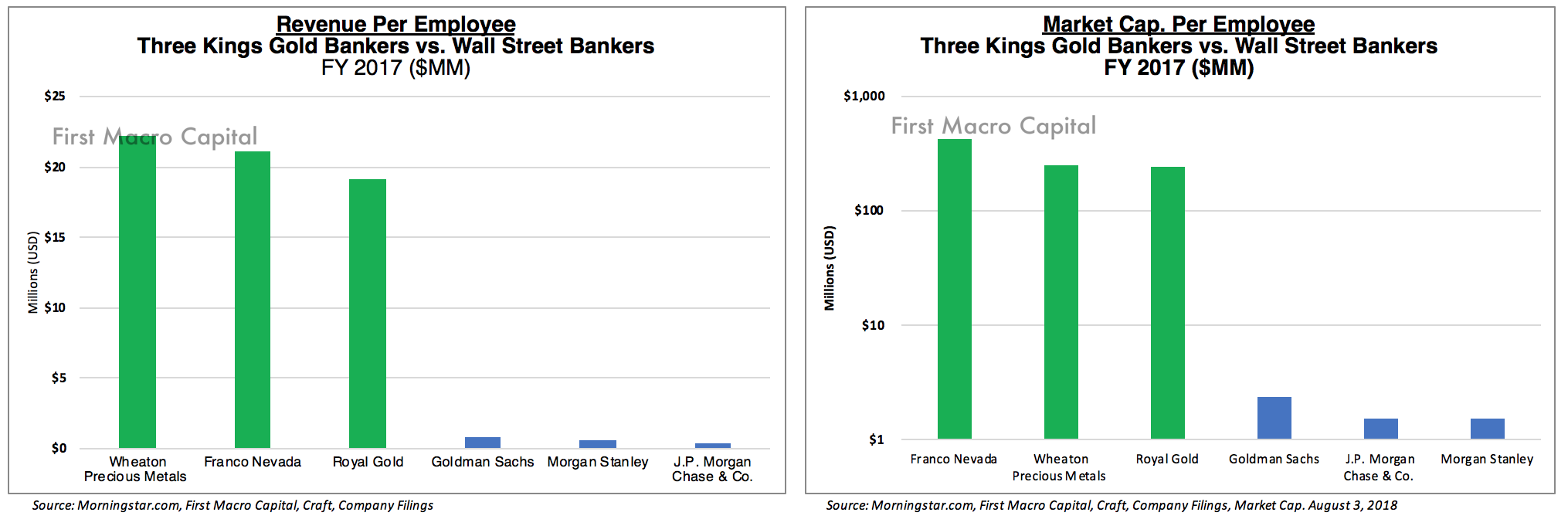

THREE GOLD KINGS vs BANKERS ON WALL STREET

For the bankers out there, this will interest you. The Three Gold Kings once again in 2017, generated 25X more revenue per employee than the key wall street investment banks (Goldman Sachs and Morgan Stanley). When you compare the Three Kings to diversified bank J.P. Morgan Chase & Co., Royal Gold generates almost 50X as much revenue per employee, and Wheaton Precious Metals generates more than 55X more. As of August, on a market capitalization basis, Franco-Nevada had 175X higher value, on a market capitalization per employee basis than Goldman Sachs, and 277X more than Morgan Stanley.

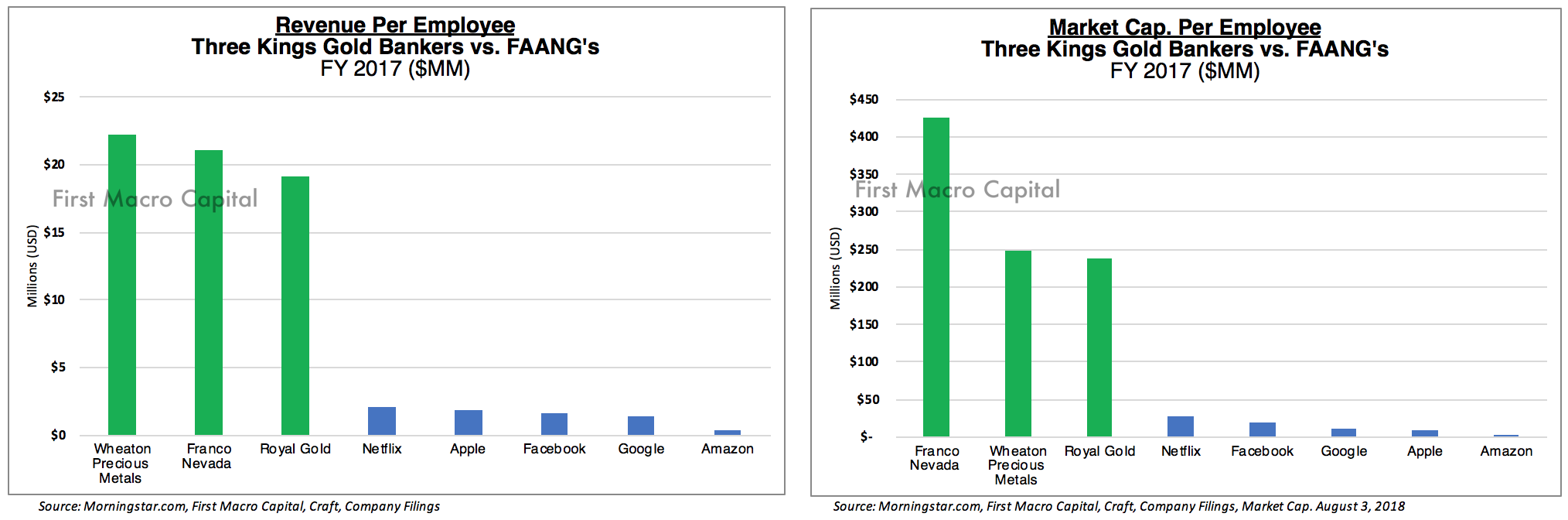

THREE GOLD KINGS vs FAANGs

Netflix is the main FAANG winner on a revenue per employee basis ($2.1 million), this is still well below that of Wheaton Precious Metals which generated $22.2 million in revenue per employee, more than 10X more. Apple was again ahead of Facebook and Google on the same metric in 2017, from 2016. Amazon is the laggard because of the number of employees it needs to hire to build out its distribution network. Google and Facebook switched on a revenue per employee position from 2016. While nowhere as extreme as the investment banks, Franco-Nevada had $425 million in market cap. per employee, more than 50X M that of Apple $8.3 million. This is AFTER Apple became a trillion-dollar company.

DEPRESSED GOLD PRICE IS GOOD FOR THE THREE GOLD KINGS

Depressed gold prices are ideal for the royalty and streaming model because both producers and explorers get starved for capital because investors are focused on other sectors. Now is no different, with gold prices down and a marijuana boom pulling in all the capital in Canada, and tech sector pulling in investor capital in the United States. This allows the royalty and streaming companies to be the bankers of last resort and get better terms than they would normally be able to get when the sector is doing well. Good luck to the banker trying to pitch a potential mine development in Africa, where a royalty and streaming company can step in and take on the risk. Their deal flow tends to be inversely related to the commodity price.

SECTOR ROTATION IS COMING?

The gold sector is incredibly unloved and unwanted, whereas the tech companies continue to be in favor. Over the next 2-3 years, we would expect the gap to widen on the two metrics, between the Three Gold Kings and the FAANG’s because of rotation out of tech and into materials. Market capitalization per employee will accelerate for the Three Gold Kings as capital flows increase to them because they tend to be in most of the gold ETFs, have liquidity, pay dividends, have reduced exposure to any one particular mine, and have a proven track record of creating shareholder wealth. On the revenue side, the Three Gold Kings are growing the attributable gold ounces, each year over the next few years, that will further push them ahead of the FAANG’s. The Three Gold Kings are doing this without having to add any new employees.

Okay, okay, but you say, show me the share price:

Royal Gold and Franco-Nevada outperformed both gold and the S&P 500, by a wide margin. Wheaton Precious Metals outperformed silver but didn’t outperform the S&P 500, because of its heavier weighting to silver. In last place, was the GDX ETF (gold miners ETF). It highlights the mining sector is more of a stock pickers environment. By outsourcing to the ETF, shouldn’t necessarily expect outperformance. Gold has been down, and the royalty and streaming model has held up well.

Why the Royalty and Streaming Model works for the Three Gold Kings?

- Wall Street and Bay Street (Canada) bankers flee the mining sector when the commodities sector is plummeting because risk and compliance assume the sector is riskier when the price is down. Which is completely illogical and irrational. This allows the Three Gold Kings to deploy capital when capital markets and traditional bank lending seizes up. Allowing them to get preferential terms because they are the banker of last resort. This is even more important when the larger miners need capital because there are fewer options to go for capital needs, particularly during challenging times. The royalty and streaming companies know the miners need capital because banks and investors have fleed.

- “Production” growth tends to continue to grow year in and year out because as each new royalty and/or stream comes online, it adds to the existing streams and royalty.

- Optionality

- Optionality to the commodity price when the commodity price increases for that the royalty or stream is tied to. The change in the gold price will flow right down to the bottom line, WITHOUT having to deploy more capital.

- Optionality to the resource. Many generalist investors completely miss this area because many times the mine can operate for many years, if not decades well after the initial mine plan because the deposit continues to grow. This allows the royalty companies to continue collecting from the mine without having to deploy any more capital.

————————

We will be hosting a Live Webcast on Thursday, August 23rd

at 8:15 PM EST / 5:15 PM PST.

Mr. Paul Farrugia (President & CEO) will be discussing an unconventional approach for gold and silver investors in the coming commodity cycle.

There will be no replay. We have limited seats.

————————

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!