In the hunt to find asset classes and/or sectors that are ripe to provide multi-year, multi-bagger opportunities, with the potential to outperform the major indices. It helps if you can find an investment that has been decimated from a massive boom, more recently has gone through a number of years of recent pains and for investors, and with only a few investors still paying attention to it.

Commodities as a whole, are one of the few assets today that meets the criteria of providing long-term value opportunities early in a cycle:

- Being decimated from a boom.

- Few investors pay attention to it = Unloved and Under owned.

- Money has been slowly coming back into commodities.

- New discoveries are being made in materials and energy but only niche investors are paying attention.

Since the commodity the washout in 2015, the Bloomberg Commodity Index is up only 14% from the lows of 2015. This is a far cry from the index generating a 222% return in the past commodities bull market.

PAST BOTTOMS IN COMMODITIES

When we look at the Bloomberg Commodity Index today versus in past cycles, we can see that there are a number of similarities to the past cycle

- Tech Bubble in 2000 to Today

- Flight to non-earnings generating IPOs is higher than in the 2000 bubble

- Accelerating twin deficits in the U.S.

- Bloomberg Commodity Index hits lows in the current cycle similar to the bottom in 1999.

- The peak in U.S. Dollar Cycle.

- QE Bubble in the 1930s to Today

- S. Federal Reserve QT Tightening causes problems in the markets after a multi-year low-interest rate environment.

- Rise in Populism in the 1930s.

HOW TO PLAY THE COMMODITY BOOM

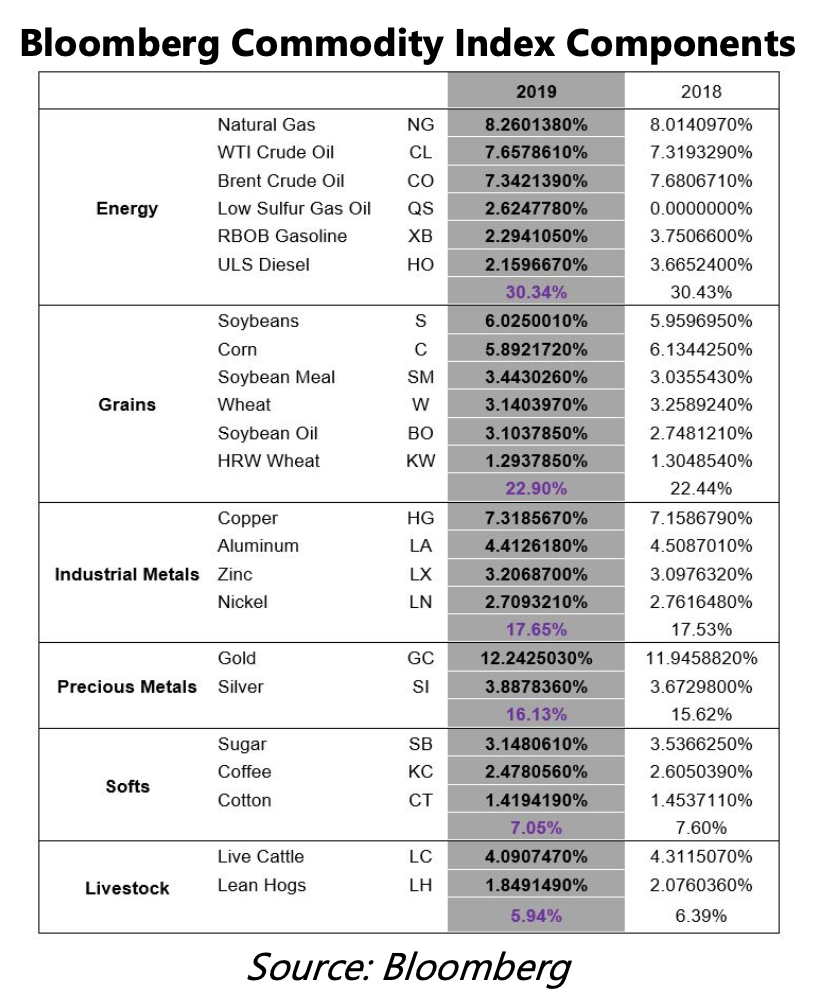

In the Bloomberg Commodity Index, there are 6 types of commodities in the basket and a total of 23 types of commodities that are in the index. As the commodities cycle unfolds in the coming years, we would expect as a whole, the basket will lift all commodities in the index, with some doing better than other over the course of the cycle. In the last commodity cycle, energy and precious metals outperformed the index. Will they repeat the same outperformance to the index this time around? Time will tell. Oil (Crude Oil & Brent) and natural gas are the top of being the most consumed commodities in terms of dollar value. In order to get the commodities benchmark moving, we would expect energy to lead the way followed by grains.

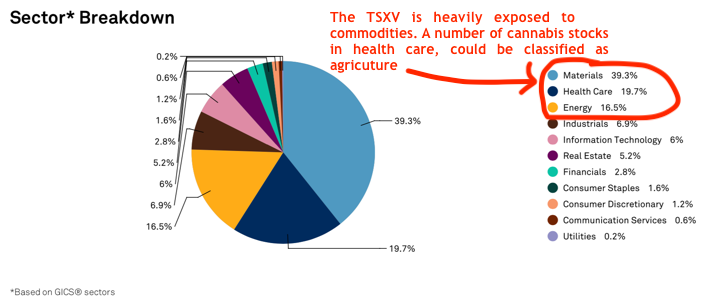

The Biggest Venture Space for Commodity Stocks is Still Early

When we look at the S&P/TSX Venture Composite, the largest index in the world that focuses on venture capital type companies related to commodities (exploration, development, production) is up only a paltry 25.5% from the 2015 lows. This includes a boost from cannabis stocks, which the index classifies as Healthcare, which has been popular in the past few years. One could say that many of these cannabis stocks are basically farmers that grow cannabis, which you could put them in the agriculture space, and the larger commodity asset classes. This makes the index having commodity exposure on the low 55.8% (Energy (16.5%) and Materials (39.3%)), potentially as high of 75.5% if we include a basket of the healthcare cannabis stocks. But not all health care stocks are cannabis related, so the commodities exposure isn’t up to the full 75.5%.

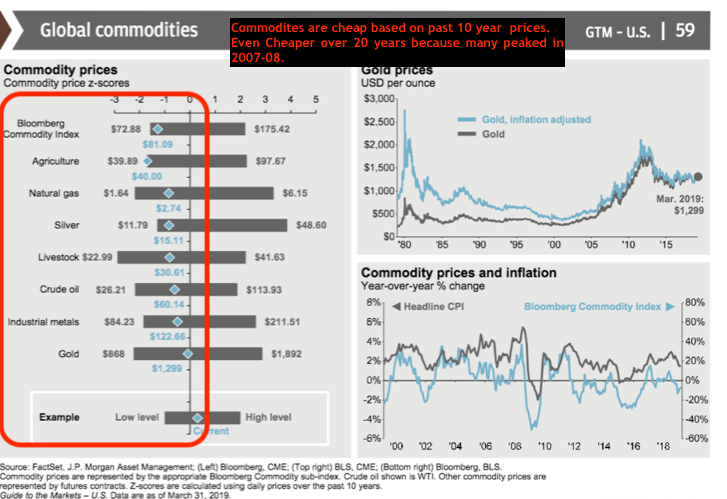

COMMODITY PRICES STILL WELL OFF THE LAST HIGHS

Prices of major commodities are at the low end of their price ranges over the past 10 years. If we take a 20-year historical time horizon, commodity prices would be down even further as many of the commodities peaked in 2007 and 2008.

WHAT FACTORS COULD DRIVE HIGHER COMMODITY PRICES?

What catalysts could we see as we go down the list of key commodity classifications that will spark higher prices? Much will be focused on the supply and demand fundamentals.

ENERGY – (Oil & Natural Gas)

- Oil and natural gas disruptions

- Geopolitical events in the Middle East, Africa, and/or South America reduces supply.

- Canadian energy projects get delayed even as energy prices rise.

- Weather causes increased demand for natural gas in North America and Europe.

- Accelerated natural gas demand growth from Asia.

AGRICULTURE – Grains, Softs, & Livestock

- Weather-related issues that impact crop planting and/or harvesting.

- Drier conditions that reduce crop growth.

- Pest issues, where pests become resilient to crop pesticides and herbicides.

- Higher feed prices because of supply issues, resulting in higher livestock prices.

- Livestock diseases that reduce the size of herds.

INDUSTRIAL METALS

- Demand growth for copper and nickel because of increased usage of these metals in electric vehicle production by the large auto manufacturers and new EV only manufactures

PRECIOUS METALS

- Demand from central bank purchases.

- Commercial banks allowed to count gold as part of their reserve calculation.

US DOLLAR CYCLE

- A weaker US because of accelerating US twin deficits will push the commodity cycle higher in the coming years.

Commodities present a rare risk-reward situation for those investors that are willing to hold on because it will take 2-3 years to generate multi-bagger returns. There will be numerous commodities that investors will be able to choose, and we suggest investors focus on the 2-3 commodities that you know best, otherwise buy the basket of commodities. Great fortunes have been made if you identify the commodities cycle correct, and when looking at the FMC Commodity Hype Cycle, we are in the early stages of the commodity cycle. With interest in commodities well off from the highs set in 2008, when the last boom peaked.

Commodities Are the Big Winners If Inflation is Dead.

What we know as of today:

- A few commodities since the washout in 2015 have made huge moves since then (Palladium, Cobalt, Lithium). These few commodities have started to bring back capital to commodities.

- The Bloomberg Commodity Index is not even up 25% from the lows set in 2015.

- Most commodities are down between 50-90% from their highs set in the last commodity cycle.

- Investor interest in commodities is down from the highs of 2008 but increasing from the lows in 2017 (See Google Trends Chart) = Unloved and under-owned.

- New world-class deposits in both mining and energy are being discovered reigniting interest in the sector.

- The political backlash against commodities makes them even more hated, because of climate change concerns, which could delay new supply coming online.

- With calls for inflation being dead, this may be the bottom of inflation, which commodities end up being big winners.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!