ATTENTION: Individual Investors, Portfolio Managers, and Investment Advisers…

“Discover How YOU Can Instantly Access Multiple Winning Stock Ideas Across Multiple Sectors…

Even If You Don’t Have Time and Experience!”

(Start Earning Dividends, Reduce Risk, BUY & HOLD To Enjoy The Maximum Uplift Of The Sector Cycle,

Potential 5X-10X Your Investment… In Just 1-2 Years!)

Dear Individual Investor, Portfolio Manager, and Investment Advisor,

The following is a message for everyone who needs more stock ideas but doesn’t have time to figure out the next sector bull market.

Here’s a huge problem you face right now.

It requires a lot of time and experience to figure out which sector and stocks to invest in

But that’s not the end of the problem…

What makes this even worse is the fact that it feels impossible to figure out where the next cycle is starting because 100,000s of smart professionals are focused on the same fundamentals and current buzzword sectors like “A.I”., “eCommerce”, or “Pot Stocks”, that it becomes difficult to find that edge!

What does that mean?

Which means by focusing on what is popular today and buzzwords, you end up buying stocks at or near the top, so you end up losing more and missing out on other sectors that are in earlier stages of a BULL market.

Which means you may keep losing a lot of money with no idea why the stock price keeps falling and when it will rise. If ever!

And…

You end up being your own worst enemy because you are buying into stocks that everyone is already in.

And, worst of all, many investors can’t get past the idea that only Fundamentals and a great story will get them rich.

All this can makes figuring out how to avoid the “value trap” stocks, yet enjoy the maximum upside of sector cycles a nightmare!

But luckily for you, there’s a solution!

So, if you’re a busy investor who wants to get winning stock ideas across multiple sectors to ride multiple sector BULL markets but can’t find the time, here’s the answer you’ve been looking for…

Introducing:

“FMC Market Cycles” Helps You

- Opportunities across multiple sectors = Endless opportunities

- Avoid Being too early by focusing just on Fundamentals = Can Get Caught In “Value Trap” -> Stays Cheaper For Longer

- Escape limiting yourself with just 1 sector = Missing Other Bull Markets

- Avoid holding onto loser stocks not sure when to get out

- Avoid Getting OUT too early, missing the entire sector bull market

- Get updates on when to enter the bull cycle and updates to keep holding on to maximize the upside. And when to exit when the cycle is over

- (For Professionals) An effortless way to take advantage of winning sectors to double your clients’ money without adding new clients

- Buy & Hold to enjoy the maximum uplift of the long-term cycle

- And, as a special bonus, you’ll also discover MULTIPLE BULL sectors to take advantage of with 3X-10X opportunities by just owning a sector!

multiple sectors

Seeking opportunities across multiple sectors

early in the cycle

Focus on opportunities early in the cycle creates long-term wealth

BUY & HOLD

Buy & Hold to enjoy the maximum uplift of the long-term cycle

focused on market cycles OVER THE LONG-TERM (2-3 YEARS)

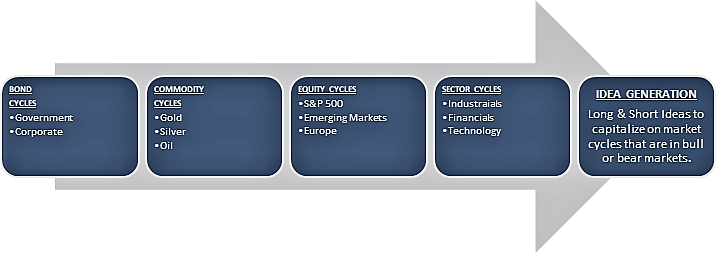

WHAT ARE WE LOOKING FOR?

We look for asset classes & sectors early in their sector cycle, because we can find stocks that present

We look for asset classes & sectors early in their sector cycle, because we can find stocks that present

DEEP VALUE OPPORTUNITIES, REDUCED RISK, and LONG-TERM UPSIDE.

How does FMC approach this?

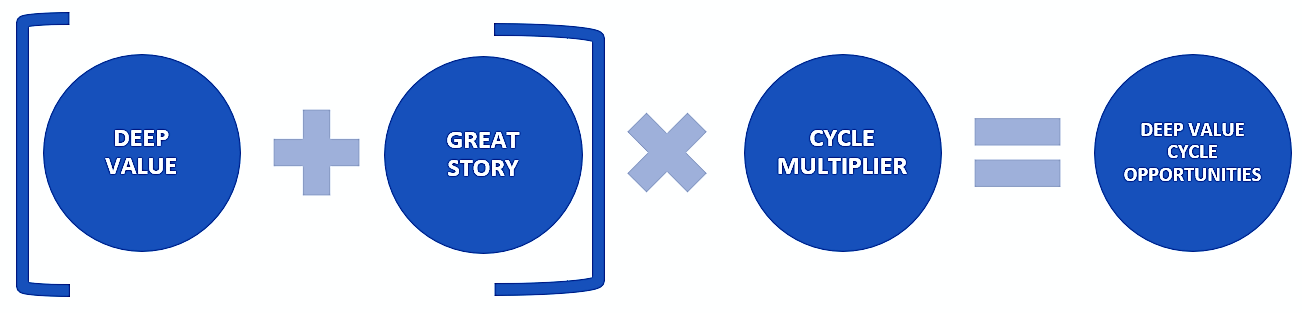

OUR SIMPLE EQUATION TO MAXIMUM UPLIFT

Most Value Investors focus on Deep Value + Great Story.

But just that alone may lead to “value trap”.

That’s why we bring in the missing piece: “Cycle Multiplier”

Allowing you to avoid the “value trap”

Enjoy the maximum uplift of the sector cycle over the long-term (2-3 years)

WHAT YOU ACHIEVE…

DEEP VALUE + GREAT STORY

INDUSTRY CYCLE GROWTH

REDUCES RISK

REDUCES WAITING AROUND

MINIMAL TRADING

LONG-TERM CYCLE UPSIDE

ASYMMETRIC OPPORTUNITIES

… and much, MUCH More!

![]() THE BEST PART: CYCLES & SECTORS TOGETHER ALLOW TO DO THIS OVER & OVER AGAIN.

THE BEST PART: CYCLES & SECTORS TOGETHER ALLOW TO DO THIS OVER & OVER AGAIN.

Now that’s a tall promise and you may be wondering…

Who Is Paul Farrugia And

Why Should I Listen To Him?

Paul Farrugia is an expert in stock investing whose accomplishments include:

Education

- Bachelor of Commerce, from University of Toronto (Global Top 25 School)

Background

- Worked directly with 2 award-winning Portfolio Managers in Toronto, Canada

- Former Vice President of Investment Research

- Former Licensed Associate Portfolio Manager

- Mining analyst at a Long-Short Hedge Fund

- Worked at the Bank of Nova Scotia and BMO Nesbitt Burns

Personal Info

- Trusted & Featured on Zero Hedge; Value Walk, Yahoo Finance, Kitco, Nasdaq, Mining.com.

- Trusted by Individual & Institutional Investors all over the world.

- Paul has advised corporate and institutional clients based in Canada, U.S., U.K., New Zealand, and China.

Paul and his team work to find the next sectors entering BULL MARKET

So as you can see, Paul Farrugia is uniquely qualified to help you understand everything you need to know about sector stock investing!

“I am tired of doom & gloom. Paul shows me the future and guides me through the noise.”

“Paul’s professional approach identifying investment opportunities – A proven way to compound wealth!“

“I don’t have time and don’t know where to start. Thanks to Paul, now I get access to MULTIPLE sectors!“

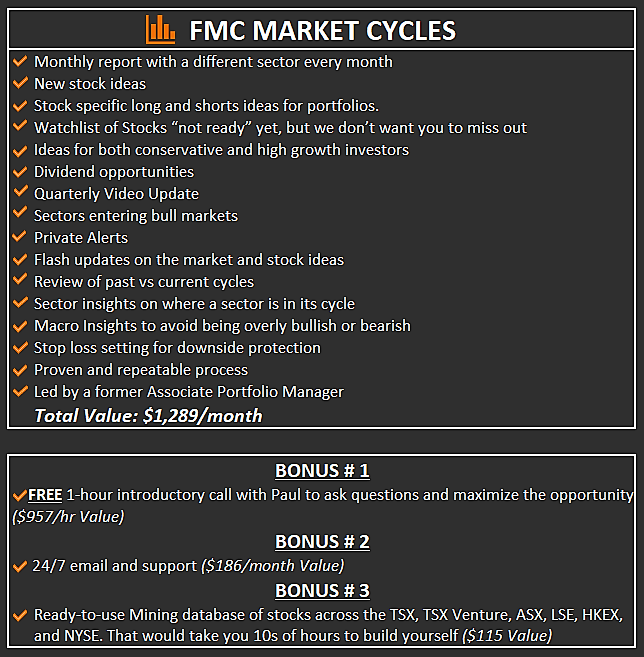

So Here’s Exactly What You’re Going To Get With

“FMC Market Cycles”

This Amazing Investment Research Report Includes:

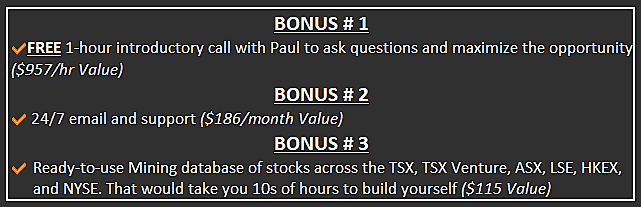

Act Now and You Also Get These Bonuses To Accelerate

Your Sector Stock Investing Success

NO huge upfront annual subscription payment, instead you are fully protected with…

Pay Monthly, Cancel Anytime

If “FMC Market Cycles” doesn’t show you winning stock and sector ideas across multiple sectors… or it doesn’t show you exactly how to participate in opportunities in MULTIPLE sector bull markets….. Then you can cancel anytime!

Special Pricing When You Order Now

So the total value of what you’re getting today is more than $1,289/month, especially when you take into consideration the incredible bonuses we’re including for you. But the good news is you are NOT going to pay that price.

Because we know what it’s like to be where you are, and because we want to do everything we can to help you succeed with sector stock investing, TODAY we’re giving you everything we just listed at a special price of ONLY $89/month!

Your Price Today: $89/Month – Cancel Anytime!

And Best Of All… You’ll Start Seeing Results Over The Long-term (just 2-3 Years).

So if you’re an individual or professional investors who wants stocks ideas across multiple sectors to ride multiple bull markets.

Identifying Opportunities Across The Cycle

So if you’re a busy investor, who wants winning stock ideas across multiple sectors.

Who is serious about avoiding the “value trap” stocks and enjoy the maximum uplift of sector cycles…

Here’s why you can’t wait and you need to ACT ON THIS RIGHT NOW.

- We’ve identified MULTIPLE WINNING SECTORS early in their cycle with potentials of 3X-10X. You don’t want to miss them again!

- Stop worrying about losing money in value traps, because we only give a “go”, when the movement is confirmed.

- We make it easier for you to increase your networth: Monthly research report with 3X-10X opportunities; multiple sectors to participate in, winning stock ideas, to grow your money, and warning alerts to protect your money.

Get Started Right Now

So go ahead, click the order button below right now and you’re well on your way to sector stock investing success!

Do it now before the exclusive bonuses get pulled forever or the price goes up.

Don’t miss these breakthrough Stocks Ideas that will show you exactly how to avoid the “value trap” sectors and enjoy the maximum uplift of the sector cycles.

Again You’ll Get…

Your Price Today: $89/Month – Cancel Anytime!

See you on the inside,

Paul Farrugia

P.S.

Never before have you had such a unique opportunity to have this PROVEN stock investing expert and his team take you by the hand and help you not only with identifying sectors and stocks entering a bull market before the masses have released it, but also show you how to avoid the “value trap” sectors and stocks, and enjoy the maximum uplift of the sector cycles – get in on this Research Report now before other investors and your competitors use it to leap way ahead of you in the market! Click Here Now!

This gem will be sold for $1,289/month. This introductory price of $89/month is a “Buy it NOW before it’s gone” offer… so act fast!…

P.P.S

Let’s be blunt: If you pass on this offer, will you succeed with sector stock investing? Probably not!

You’ll just keep struggling and never figure out why you lose on “value traps”. Meantime, watching on a sideline how others succeed from MULTIPLE sector cycles.

Get access to Market Cycles NOW and get the sector stock investing success you‘ve always wanted!

Act now! Pay monthly – Cancel anytime. Click here!

Disclaimer

Market Cycle Alerts are provided as information only and should not be taken as investment or trading advice. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. Subscribers to the FMC Market Cycles agree to the disclaimer.