Why Bitcoin is Silver’s Best Friend in 2018

2018 is a new year, and January is the start of predictions for what will happen in 2018. Silver forecasts for 2018 have started to come in and it is interesting what they are saying. But more importantly what the silver forecasts are not saying. Bitcoin was all the rave in the investment community last year.

WHAT WAS ALL THE ATTENTION IN 2017?

Much of the news in 2017 was focused on bitcoin, and it seemed like you couldn’t turn on anything without some article on bitcoin, a video, or meet people talking about bitcoin. The top Global News events in 2017 were not surprisingly related to weather, violence, a giraffe, with bitcoin holding #2 spot. I think one of the most asked questions in investing in 2017 was “So what do you think of Bitcoin?”. It was almost a guaranteed question that was asked.

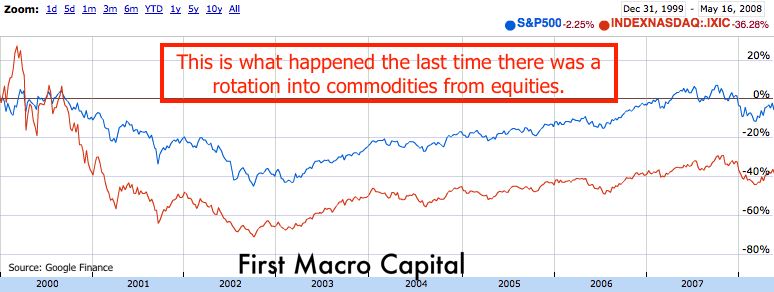

Bitcoin is in a bear market territory, it is down more than 20% from its high, and it needs to break above $16,000 USD, or go above 80% from its high to signal the bear market is over. Another generation has repeated what past generations have done before them, in saying this time is different with bitcoin. Rinse and repeat for the next generation, after them. Just like the tech dot-com bubble in 2000, and everyone hoped for the stars, and relied on non-revenue earning websites. Now, these new lessons influence how they think about their next investments. These speculators will go back to finding things that are easy to understand and they can explain.

“The minute you get away from the fundamentals – whether it’s proper technique, work ethic, or mental preparation – the bottom can fall out of your game.” Michael Jordan

TAKING THE TEMPERATURE ON SILVER

I had a conversation recently with an analyst, and I mentioned the word “gold”? There was some intrigue, but not much. Then I mentioned the word “copper” …a bit more interest because the economy is doing well. How about “battery metals or energy metals like cobalt or lithium” …EYES LIGHT UP….and silver…. nothing, no reaction, he wasn’t sure really what to say…. we are on to something. Let’s keep digging….

WHAT ARE PEOPLE SAYING FOR SILVER IN 2018

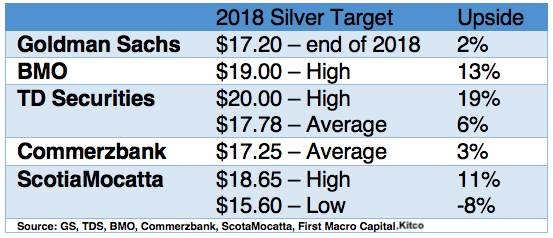

Silver closed 2017 at 16.82/oz. and has really remained flat to start the year, closing at $17.09/oz. on Friday, January 18. It is still early in the year, 11 ½ more months of trading to go. A lot can happen.

Looking at the sell-side analyst estimates, for the most part, they are only slightly bullish on silver. TD Securities is definitely an outlier, but for the most part, analysts are not paying much attention to the price because their clients (producers, hedge funds, etc., manufacturers) are not paying too much attention, yet. The median upside target between these 5 firms is only 11% upside, putting silver at a price target of $18.67 or about 9% to go, from Friday’s close. Nothing to see here folks, keep moving along. Is there something that people are missing?

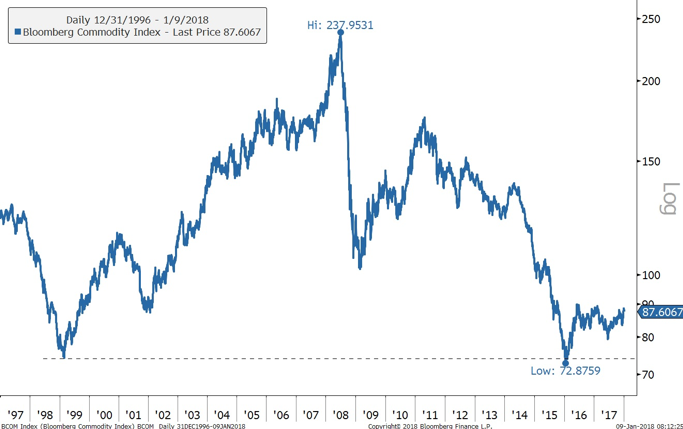

ALL BOATS RISE IN COMMODITY BOOMS

When you look at past historical commodity booms from the 2000’s and 1970’s, was it just oil and gold going up? No. You saw the majority of the commodities go up because there was a rotation from equities to hard assets. The main benchmark that is the source is the S&P GSCI Index. And what is inside the S&P GSCI Index? 18 different commodities focused on Energy (Crude Oil & Natural Gas), Agriculture crops like wheat and soybean, livestock, base metals, and precious metals. All boats rise together in the commodity boom as investors buy the basket of commodities. The lesson, pick the commodity you know well. Silver is one of those that I know. Pick the one that you know the best, you’ll be able to find bigger rewards during the boom.

WHAT HAPPENED TO THE EQUITIES DURING THE ROTATION?

Remember the NASDAQ and S&P really didn’t do anything for 10 years, after the tech bubble burst in 2000, and broader equities underperformed hard assets like commodities. Commodity countries boomed, like Australia, Canada, Chile, and Russia.

SILVER ISN’T GETTING MUCH LOVE

Silver accounts for a small portion of commodity trading, so it doesn’t get much attention right now, particularly when other commodities like marijuana crops and energy metals are getting all the attention. That’s fine. It’s good for those to accumulate more. But slowly and surely silver is moving up. Silver was up 17.5% in 2016 and 3.6% in 2017. History tells us, this is normal. With all the attention given to Bitcoin now its collapse since peaking in December, and energy metals now all the rage, as the demand increases from electric vehicles because of government and company announcements focusing on EV’s. No one is talking about the increasing demand coming from the increasing usage of silver in the Internet of Things. This trend is kind of big deal when you have fridges, and stoves, and microwaves all getting hooked up to the internet, you need silver.

If you apply the longer-term contrarian view, silver may represent incredible long-term upside, and no one is putting much value to it, just look at the analyst estimates, we mentioned earlier.

WHAT IS THE POTENTIAL FOR SILVER?

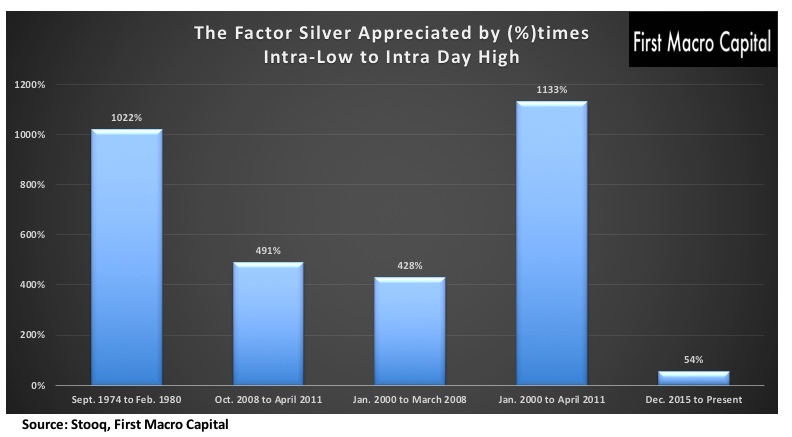

For those investing in the silver sector, silver’s upside once it gets moving, can be quite profitable. Professional investors want the risks of downside low and the upside – high. It is a benefit to those reading this today, you have an opportunity to do the work now to identify the silver investment that is of interest to you. Use the opportunity that, everyone is focused on bitcoin and energy metals, and technology to your advantage.

YOU ARE EITHER READY OR YOU OR NOT

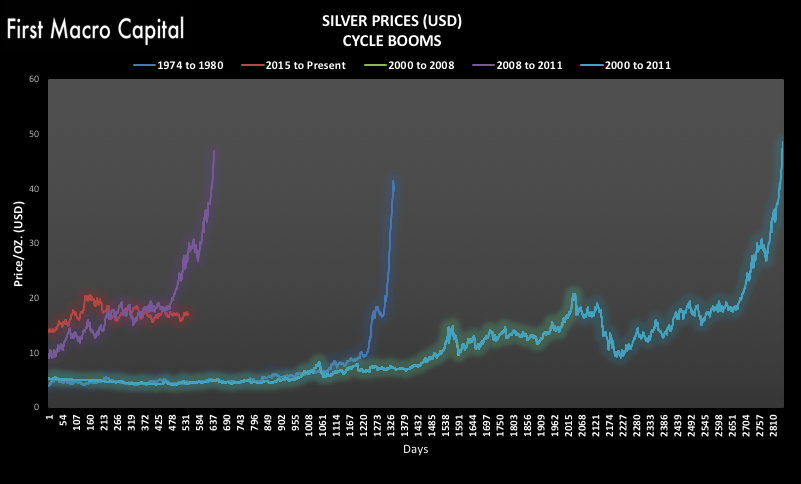

Much of the phase transition, THE BOOM, takes place in the final 10-20% of the bull run. This is when you start to see the price of the asset go parabolic, and the analyst estimates start to double or triple from the current price. Silver is not there yet. Analysts are only expecting single to low-digit moves. BUT, before the price starts to go parabolic, you see 2X and 3X times price appreciation from the bottom, before the average investor starts to get excited. In 2015, Silver bottomed at $13.43 and it is only up 28%. It has gone as high as 54% but came back down. We could see a pullback silver, in the near-term if the economy slows down. Silver did this in 2000, but all assets, particularly broader equities cyclically rotated into commodities. This is part of the process. We shall see how the ISM’s holdout in 2018. Take a longer-term view, 2-3 years, and you must expect it won’t go straight up.

Looking at the past silver booms, we can see that a majority of the move takes place in the final 10-20%. It slowly crept up, the smart money was in early, that made explosive moves higher.

BE PATIENT WITH SILVER IN 2018

Use the lessons of bitcoin to your advantage. In the beginning, not much attention was given to Bitcoin by the general media and average retail investors, including institutional investors that tend to be slower moving. Sounds like Silver? Yes and Yes. We could see some turbulence if the economy slows, but we are in a cyclical rotation out of technology into hard assets. You know you are near the peak when politicians are being negative in a sector because of all the profits being made. Technology is that sector today. Oil and gas were before that, and in mining before that, when governments were trying to take over mines and ratchet up the royalties.

And we are still early on. You need the combination of quality of assets in silver that you own and the timing. When taking into account:

- The historical upside that silver makes

- The cyclical rotation into commodities

- Silver has not yet moved in relation to other assets (i.e. – no love, no attention)

USE THIS AS AN OPPORTUNITY TO IDENTIFY GROWING SILVER STOCKS

A lot of sell-side analysts focus on NAV/share when they are comparing mining stocks, this includes gold stocks, silver stocks, and just about anything that involves mining. The challenge when you pitch NAV/share to a portfolio manager that gets scored how well they are doing on a weekly, and monthly basis, NAV/share doesn’t help on a monthly or quarterly basis too. Portfolio managers want factors that will make the stock become worth more in the future. Assuming you don’t know what the silver price will be tomorrow. What will be the 2-3 factors that will make the share price worth 50-200% more? And how long will it take to get there? Finally, what are 2-3 factors that will make the share price go down by 20-30%?

“Know what you own, and know why you own it”

BE OPEN TO DIFFERENT TYPES OF SILVER INVESTMENTS IN 2018?

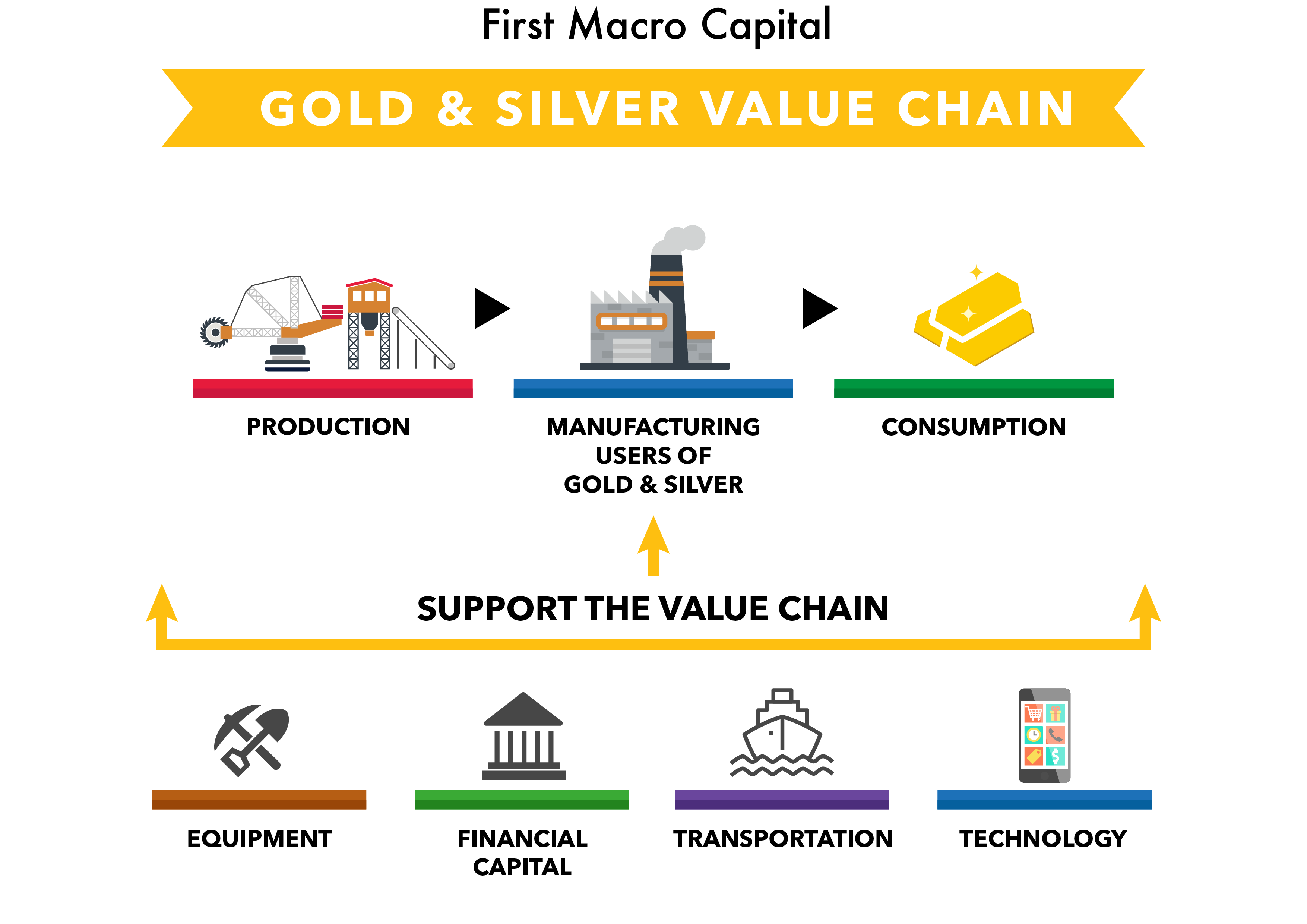

Use the value chain approach to identify a hidden value that a company has. You can do this now when no one is paying attention to silver stocks. Unless you are buying physical silver, there are different rewards and risks to consider. Your timing will be wrong, 100%. Look at your past investments, how early or late you were. Apply this to your silver investment. This will make sure you take into account you will be able to survive over an extended time. Look at the bankers who help finance deals, asset managers, who have silver exposure. Silver mining stocks, silver explorers, and developers are not the only way to invest in silver.

2017 was the year of Bitcoin and weather, and 2018 is an opportunity for silver investors to start to pay attention to silver investments because no one is paying attention to it. You are either ready or you are not. Focus on the fundamentals of the silver investments you make, and make sure it matches your time horizon because it could take it longer than you expect. There will be ups and downs on the way higher, it is never straight up.

Paul Farrugia, BCom. Paul is the President & CEO of First Macro Capital. He helps his readers identify gold & silver mining stocks, including energy metals stocks that you can hold for the long-term. He provides a checklist to find winning mining producer stocks.

Disclaimer:

The information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your financial situation – we are not investment advisors, nor do we give personalized investment advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated, and there is no obligation to update any such information.

Investments recommended in our publications, blog posts, emails, online communications, or any online contents published by any party of First Macro Capital and its affiliated companies should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. You should not make any decision based solely on what you read here.

First Macro Capital writers and publications do not take compensation in any form for covering those securities or commodities. First Macro Capital employees and agents of First Macro Capital and its affiliate companies do not own any of the ETFs mentioned in this article at the writing of this article.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!