In our hunt to find sectors and assets early in the cycle, few assets have been in a more protracted bear market than nickel. Nickel is part of the overall commodities complex, which has been in a multi-year bear market since 2008. In the 2000s, the demand that drove the bull market in commodities, came from China as its real estate and infrastructure boom took hold. But what will be the main catalyst that drives the next commodities boom? In our view it is the electric vehicle boom, that will be the catalyst for higher nickel prices. Nickel fits the fundamental story of being cheap relative to other sectors and commodities, it has the story driven by the electric vehicle boom. But does it have the cycle multiplier that we at First Macro Capital seek out, to provide those multi-year structural dynamics for massive asymmetric returns?

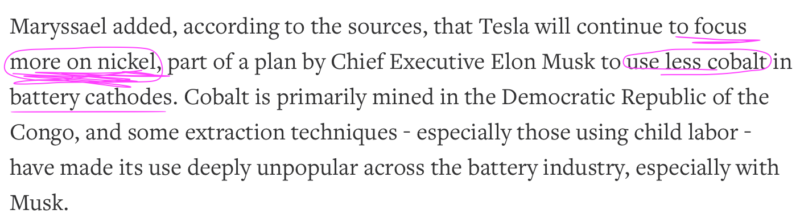

Tesla has stated there is a massive shortage of battery metals coming.

Predicted vs Actual

Let’s put this in context with electric vehicle sales, that are starting to hit the exponential curve over the next 2-4 years in terms of sales demand, and it will only accelerate as oil prices rise during the commodity cycle.

There are estimates that nickel demand will increase by 10X, by 2023, and 19X by 2028, but that is at 100% utilization, and everything working correctly. Even if these estimates of demand for nickel and cobalt are HALF right, nickel would see demand rise by 5X, and cobalt by 2X in only 4 years. We are now only 6 years away from 2023, with demand expected to grow from the electric vehicle sector by more than 20%/year for nickel and cobalt.

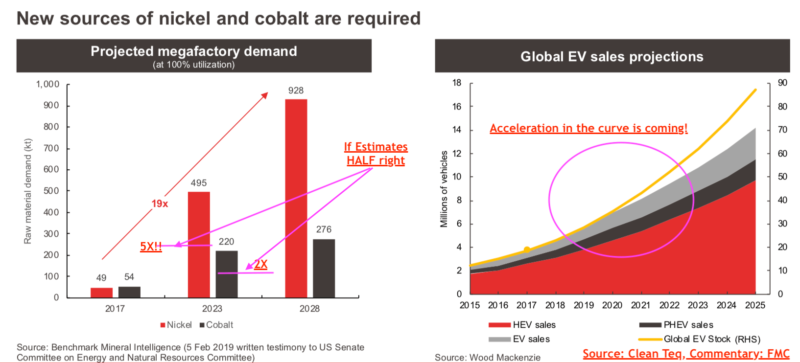

In October 2017 there were only 17 Li-ion battery mega-factories under construction, now in 2019, there are more than 70 mega-factories that are currently being constructed. All of the battery plants are going to be consuming a lot of nickel and cobalt. There are two battery methods being deployed, and whatever is chosen by the manufactures, will there be enough nickel to go around?

THE NICKEL SHORTAGE

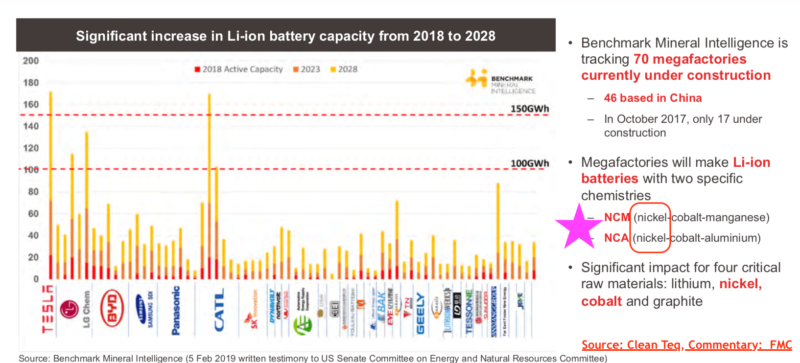

For the past three years, there have been deficits for global refined nickel as the surplus has come way down after the past boom, to a deficit situation, and, it will only accelerate as the electric vehicle boom accelerates. There is the potential that the nickel deficit will overshoot to the downside as no one truly knows what the demand will be for electric vehicles. We could see lower nickel prices in the near-term if there is a global slowdown as nickel demand is tied to the health of the global economy, but after the slowdown, industrial metals like nickel perform strongly.

MAJORS ARE PAYING ATTENTION

We even recently had BHP withdraw selling its nickel assets, putting BHP in position in what it sees, is accelerating demand for nickel coming from the electric vehicles.

SUPPLY CRUNCH FOR NICKEL IS COMING

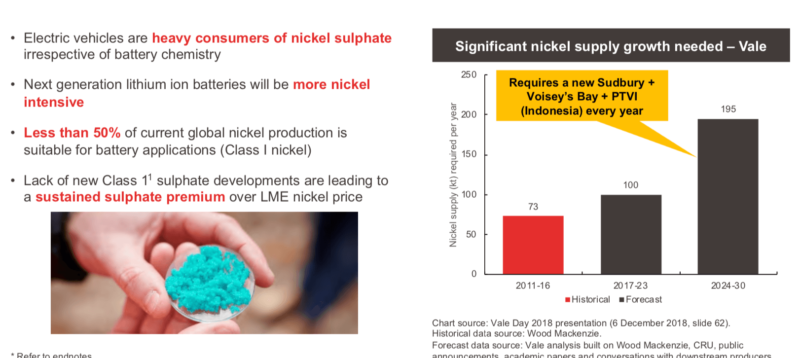

But new mines are not coming online fast enough for the accelerating nickel demand growth. Vale estimates there needs to be a new Sudbury, Voisey’s Bay and PTVI built every year from 2024-30. Even if they are half right, new nickel mines will have to be brought online presenting wonderful opportunities.

But Where is Nickel Today?

The nickel price is down more than 70% from its high set in 2007, but up more than 50% from the low set in 2016.

Nickel has been a disaster for more than 10 years, but with the price action is getting ready to turn, with the fundamentals and the story matching up, but the turning point for nickel price does not appear just yet.

Conclusion

- Nickel which peaked in 2008, with the commodity complex, and bottomed with the commodity index, is setting higher lows, highlighting the worst is over for nickel.

- As global EV production rises along the exponential curve, and if demand for nickel is half right about nickel demand from EVs, nickel will see demand rise more than 5X by 2023, and 9X by 2028.W

- A supply crunch is expected to occur, as the number of super mines like Sudbury, Voisey’s Bay, and PTVI to be built every year during 2024-30.

- While the fundamental and story make are clearly there for nickel, with the EV picture, the cycle momentum has not yet entered a clear buy in our opinion, currently reflected in the price action of nickel. A global slowdown could knock down nickel prices in the near-term but over the next 2-3 years we look to see if nickel prices accelerate higher and momentum comes.

Paul Farrugia, BCom. Paul is the President & CEO of First Macro Capital. He helps his clients take advantage of cycle opportunities across all sectors and asset classes, for the long-term. He provides a checklist to find winning gold and silver mining producer stocks, to take advantage of the commodity cycle.

Disclaimer:

The information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your financial situation – we are not investment advisors, nor do we give personalized investment advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It may become outdated, and there is no obligation to update any such information.

Get the exact checklist that Professionals use to find winning Gold mining producer stocks.

Apply this to any mining producer stock in under 30 minutes!